By ALEXANDER BURNS from NYT U.S. https://nyti.ms/2IPRvGz

From today, Uber has added public transport to its app in London, incorporating real-time information on the city’s Underground, Overground, train and bus network, as well as other trams, shuttle, river boat and the DLR’s driverless trains.

Last summer the ride-hailing giant was granted a provisional 15-month license to operate in the U.K. capital — after appealing against the shock 2017 decision of transport regulator, TfL, to reject its application for a licence renewal.

But instead of the standard five-year license, a judge gave Uber 15 months grace to continue working to satisfy conditions that Transport for London had said it had failed to meet when it made the decision not to grant a license renewal — deeming Uber “not fit and proper to hold a private hire operator licence”.

The TfL decision focused mainly on concerns around passenger and driver safety. But Uber was also called out for a questionable approach to regulatory oversight, with TfL saying it had failed to adequately explain local use of software designed to thwart checks by regulatory and/or law enforcement officials. (Aka its controversial Greyball program.)

The wider theme here is Uber being called to heel to work with regulators, rather than seeking to hack their rulebooks and thumb its nose at city priorities — as was the case with its earlier expansionist playbook under founder Travis Kalanick.

TfL has been working on updating its regulatory framework for ride-hailing, and actively pushing for ride-hailing firms to share data with it.

While London’s mayor, Sadiq Khan, has made tackling London’s awful air quality, a policy priority — launching an ‘ultra-low emission zone’ in central London earlier this month which levies extra charges on motorists with more polluting vehicles if they drive into the zone.

Adding public transport options in London is an easy way for a rebooted Uber — under baggage-free CEO Dara Khosrowshahi — to get with this zeitgeist and project a more collaborative, civic-minded, environmentally aware aura atop a business that nonetheless still competes with public transit by encouraging people to pay to take a car ride home, rather than hop on the bus…

Had the chance to try our new Public Transport option, launching today in #London with live bus and tube times from @TfL in the @Uber app. All part of our goal to help people replace their car with their phone. More to come! pic.twitter.com/UVfgLbeLQ9

— dara khosrowshahi (@dkhos) April 29, 2019

To wit: Uber’s own S-1 Form lists public transportation as a direct competitor and thus one of the risk factors affecting future growth of its business: “Our Personal Mobility offering competes with personal vehicle ownership and usage, which accounts for the majority of passenger miles in the markets that we serve, and traditional transportation services, including taxicab companies and taxi-hailing services, livery services, and public transportation, which typically provides the lowest-cost transportation option in many cities.” [emphasis ours]

So the cold-eyed capitalist view says Uber gunning to become a ‘one-stop shop’ transport app by assimilating London’s public transit, and presenting it as a comparative option alongside its own hail-able rides, offers a route for the company to capture more users and upsell those who land in its app intending to get the bus/train/metro on calling an Uber instead.

You can see this strategy at work in the design of the public transit addition — with “public transport” only appearing as an option after riders enter a destination into the app, and then with results presented in a tab that sits alongside UberX and UberPool.

This means Uber is suggestively positioning publicly funded transport alongside rides that pour money its own tax shifting coffers — thereby eroding the taxpayer value distinction between what are actually very different options by inviting its users to think of getting an Uber as ‘equivalent’ to getting the train or bus, when it’s anything but.

So even when the company claims to be ‘working with cities’, the cold hard truth is its business demands that it competes and substitutes better value transport alternatives. Expect dark patterns.

The move into public transport also shifts Uber deeper into the territory of rival urban navigator app, Citymapper, which has been dabbling in tie-ups to push shared rides via its own app for a few years — and thus seeking to more directly squeeze Uber.

Commenting on the public transport addition to the London Uber app, David Reich, head of transit at Uber said: “With 3.5 million Londoners relying on Uber, we recognise the important responsibilities that come with being a good partner to this great global city. We share many of the same goals as the cities that we serve and are committed to addressing the same challenges: reducing individual car ownership, expanding transportation access and tackling air pollution.”

Reaching for a response to the update, a TfL spokesperson told us: “Our data is open to everyone, with more than 675 mobile phone and online apps already powered by our feeds. We provide up-to-the-minute information, making it easier for millions of people each day to move around our city by helping them plan their journeys.”

For the record Uber’s business was founded in 2009, while the London Underground has been ferrying people around the capital since 1863. The first omnibus service got going in London in 1829.

Asia Pacific grocery delivery startup Honestbee has confirmed it is suspending business in half of the eight markets it operates in and laying off 10 percent of its 1,000 staff. The cost-cutting appears to be part of belt-tightening ahead of a planned new injection of funding, TechCrunch has come to learn.

According to a statement shared today, Honestbee is “halting our services in Hong Kong and Indonesia” while its business in Japan and the Philippines — and some partnerships in other countries — will be “temporarily suspended” while an internal review is conducted. It also operates in Singapore, Taiwan, Thailand (where it has paused its food delivery service) and Malaysia.

One of the big concerns around Honestbee’s future is its lack of financing, as TechCrunch reported last week. The company has raised around $60 million in disclosed funding from investors, which does not match its currently monthly losses of around $6.5 million. A source told TechCrunch that Honestbee is expecting to win new financing by the middle May and that will give it a further year of runway. However, it is unclear what investor is providing the money and exactly how much it might be. The source suggested it may be Formation Group, which has backed the company since its $15 million Series A round was announced in October 2015.

An Honestbee spokesperson declined to comment on the company’s funding plans.

Beyond the cash burn, we reported that the company has unpaid bills owed to a range of suppliers and partners across its eight markets. Honestbee said last week that it would layoff six percent of staff but we reported at the time that more terminations were planned — today’s statement confirms that the number is indeed higher than first disclosed.

We also wrote that four-year-old Honestbee had told staff in Singapore, its HQ, that it would not make payroll on time this month. The company said today that is not true. Sources told TechCrunch that Honestbee told staff last week that management in Singapore would not be paid on time, but an update this week communicated that the payment would not, in fact, be delayed after all.

New funding may stave off the need to sell the business, but Honestbee’s ongoing talks with suitors — which we reported have included ride-hailing firms Go-Jek and Grab — are ongoing. Possible outcomes could include the company’s selling its local operations in some markets in Southeast Asia to streamline its costs. One thing we do know from today is that it will continue with its Habitat supermarket, which combines on- and offline retail and is likely to be capital intensive.

Here is the full statement from Honestbee:

In 2015, honestbee started in Singapore with the mission of providing positive social and financial impact on the lives and businesses that we touch. Today, we are a regional business committed to making great food experiences accessible to customers across Asia.

Over the past four years, we have demonstrated commitment to our staff, partners and customers, and continue to innovate and improve our business to stay relevant in today’s rapidly-changing business environment. The launch of habitat by honestbee in Singapore last October marks the next phase in our evolution as a food company.

As part of an ongoing strategic review of our business, we are halting our services in Hong Kong and Indonesia, as well as our food vertical in Thailand. Our services in Japan and the Philippines, along with specific partnerships in others markets are also temporarily suspended as part of this review. This is necessary to help us focus and align our regional business, and more importantly, to enable us to better meet our customers’ needs. The status of honestbee’s business in the remaining markets stands unchanged.

Some roles within the organisation will no longer be available. Approximately 10% of our global headcount in the organisation are affected.

There have been media reports regarding payroll delay for our employees. We would like to stress that this is untrue. We will ensure that all employees across all markets, including Singapore, are paid in a timely manner.

In addition, we are also committed to fulfilling our financial obligations to all Bees, partners and vendors.

For context, our original report is below:

If you have a tip about this story or others, you can contact TechCrunch reporter Jon Russell in the following ways:

Garmin announced today that it will be adding menstrual cycle tracking to its line of trackers and smartwatches. The new feature gives users the ability to log symptoms, track cycles and offers up additional context by way of Garmin Connect, the company’s mobile app.

The addition follows a similar feature instituted by Fitbit, roughly this time last year. It’s since become a mainstay across the company’s tracker and smartwatch offerings. In spite of still being associated with GPS, Garmin has become a major wearable player in its own right, generally rounding out the global top five, courtesy of devices focused on sports and outdoor functionality.

Garmin’s offering sounds pretty similar to Fitbit’s primarily focused on offering users a way to log this information in a centralized location along with the rest of the health data Garmin’s devices track. The contextual information, meanwhile, continues tidbits such as,

The new feature comes as Garmin is looks to expand its wearables’ appeal by offering additional smaller sizes of its devices. The new menstrual cycle tracking feature is available to users starting this week via Garmin Connect. A number of devices will get a widget for the feature, including the Forerunner 645 Music, vívoactive 3 and Fenix 5 Plus Series. A handful of additional devices will be getting it soon.

Companies are on the hunt for ways to reduce the time and money it costs their employees to perform repetitive tasks, so today a startup that has built a business to capitalize on this is announcing a huge round of funding to double down on the opportunity.

UiPath — a robotic process automation startup originally founded in Romania that uses artificial intelligence and sophisticated scripts to build software to run these tasks — today confirmed that it has closed a Series D round of $568 million at a post-money valuation of $7 billion.

From what we understand, the startup is “close to profitability” and is going to keep growing as a private company. Then, an IPO within the next 12-24 months the “medium term” plan.

“We are at the tipping point. Business leaders everywhere are augmenting their workforces with software robots, rapidly accelerating the digital transformation of their entire business and freeing employees to spend time on more impactful work,” said Daniel Dines, UiPath co-founder and CEO, in a statement. “UiPath is leading this workforce revolution, driven by our core determination to democratize RPA and deliver on our vision of a robot helping every person.”

This latest round of funding is being led by Coatue, with participation from Dragoneer, Wellington, Sands Capital, and funds and accounts advised by T. Rowe Price Associates, Accel, Alphabet’s CapitalG, Sequoia, IVP and Madrona Venture Group.

CFO Marie Myers said in an interview in London that the plan will be to use this funding to expand UiPath’s focus into more front-office and customer-facing areas, such as customer support and sales.

“We want to move into automation into new levels,” she said. “We’re advancing quickly into AI and the cloud, with plans to launch a new AI product in the second half of the year that we believe will demystify it for our users.” The product, she added, will be focused around “drag and drop” architecture and will work both for attended and unattended bots — that is, those that work as assistants to humans, and those that work completely on their own. “Robotics has moved out of the back office and into the front office, and the time is right to move into intelligent automation.”

Today’s news confirms Kate’s report from last month noting that the round was in progress: in the end, the amount UiPath raised was higher than the target amount we’d heard ($400 million), with the valuation on the more “conservative” side (we’d said the valuation would be higher than $7 billion).

“Conservative” is a relative term here. The company has been on a funding tear in the last year, raising $418 million ($153 million at Series A and $265 million at Series B) in the space of 12 months, and seeing its valuation go from a modest $110 million in April 2017 to $7 billion today, just two years later.

Up to now, UiPath has focused on internal and back-office tasks in areas like accounting, human resources paperwork, and claims processing — a booming business that has seen UiPath expand its annual run rate to more than $200 million (versus $150 million six months ago) and its customer base to more than 400,000 people.

Customers today include American Fidelity, BankUnited, CWT (formerly known as Carlson Wagonlit Travel), Duracell, Google, Japan Exchange Group (JPX), LogMeIn, McDonalds, NHS Shared Business Services, Nippon Life Insurance Company, NTT Communications, Orange, Ricoh Company, Ltd., Rogers Communications, Shinsei Bank, Quest Diagnostics, Uber, the US Navy, Voya Financial, Virgin Media, and World Fuel Services.

Moving into more front-office tasks is an ambitious but not surprising leap for UiPath: looking at that customer list, it’s notable that many of these organizations have customer-facing operations, often with their own sets of repetitive processes that are ripe for improving by tapping into the many facets of AI — from computer vision to natural language processing and voice recognition, through to machine learning — alongside other technology.

It also begs the question of what UiPath might look to tackle next. Having customer-facing tools and services is one short leap from building consumer services, an area where the likes of Amazon, Google, Apple and Microsoft are all pushing hard with devices and personal assistant services. (That would indeed open up the competitive landscape quite a lot for UiPath, beyond the list of RPA companies like AutomationAnywhere, Kofax and Blue Prism who are its competitors today.)

Robotics has been given a somewhat bad rap in the world of work: critics worry that they are “taking over all the jobs“, removing humans and their own need to be industrious from the equation; and in the worst-case scenarios, the work of a robot lacks the nuance and sophsitication you get from the human touch.

UiPath and the bigger area of RPA are interesting in this regard: the aim (the stated aim, at least) isn’t to replace people, but to take tasks out of their hands to make it easier for them to focus on the non-repetitive work that “robots” — and in the case of UiPath, software scripts and robots — cannot do.

Indeed, that “future of work” angle is precisely what has attracted investors.

“UiPath is enabling the critical capabilities necessary to advance how companies perform and how employees better spend their time,” said Greg Dunham, vice president at T. Rowe Price Associates, Inc., in a statement. “The industry has achieved rapid growth in such a short time, with UiPath at the head of it, largely due to the fact that RPA is becoming recognized as the paradigm shift needed to drive digital transformation through virtually every single industry in the world.”

As we’ve written before, the company has has been a big hit with investors because of the rapid traction it has seen with enterprise customers.

There is an interesting side story to the funding that speaks to that traction: Myers, the CFO, came to UiPath by way of one of those engagements: she had been a senior finance executive with HP tasked with figuring out how to make some of its accounting more efficient. She issued an RFP for the work, and the only company she thought really addressed the task with a truly tech-first solution, at a very competitive price, was an unlikely startup out of Romania, which turned out to be UiPath. She became one of the company’s first customers, and eventually Dines offered her a job to help build his company to the next level, which she leaped to take.

“UiPath is improving business performance, efficiency and operation in a way we’ve never seen before,” said Philippe Laffont, founder of Coatue Management, in a statement. “The Company’s rapid growth over the last two years is a testament to the fact that UiPath is transforming how companies manage their resources. RPA presents an enormous opportunity for companies around the world who are embracing artificial intelligence, driving a new era of productivity, efficiency and workplace satisfaction.”

Nigeria based startup Tizeti, an internet service provider, today launched WifiCall.ng—an internet voice-calling platform for individuals and businesses.

WifiCall is a VoIP—or Voice over Internet Protocol—subscription service that allows unlimited calls to any phone number, even if that number isn’t registered on WifiCall’s network.

Tizeti will offer the product in Nigeria for now, with plans to open it up to phone numbers outside Africa’s most populous nation and largest economy in 2020.

WifiCall was influenced by popularity of WiFi enabled voice services such WhatsApp, in Africa, and the continent’s improving digital and mobile profile.

With its new VoIP product, Tizeti looks to contend with the likes of Skype, WhatsApp, and major telcos.

“On the low end we’re competing with the mobile providers. WifiCall gives you a real number and it’s cheaper. But we’re also offering enterprise options you would not get with a mobile connection or even WhatsApp,” Tizeti co-founder and CEO Kendall Ananyi told TechCrunch.

“On the low end we’re competing with the mobile providers. WifiCall gives you a real number and it’s cheaper. But we’re also offering enterprise options you would not get with a mobile connection or even WhatsApp,” Tizeti co-founder and CEO Kendall Ananyi told TechCrunch.

In addition to individual users, businesses and startups can use WifiCall for internal communications or open it up to developers to customize APIs for white-label, customer applications.

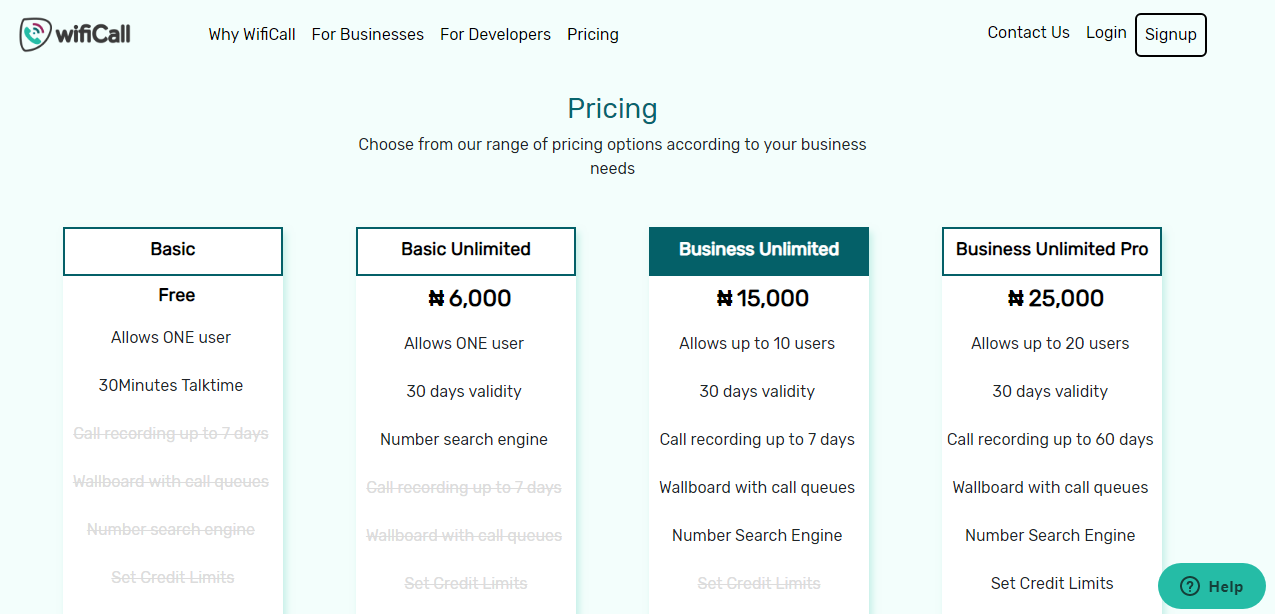

WifiCall is available online or for download for free under the “Basic” package. The entry level commercial “Business Unlimited Pro” package—that offers up to 10 users, call recording, and call analytics—goes for ₦15,000, or around $35 a month.

Nigerian trucking logistic startup Kobo360 is already is a client. Ananyi sees prospective market segments for WifiCall as startups, educational institutions, hotels, gated communities, and “regular users anywhere they have tower coverage,” he said.

That last group ties into Tizeti’s core business, which is building solar powered towers that offer WiFi service packages and hotspots in and around Lagos and Ogun State, Nigeria. Since its launch from Y Combinator’s winter 2017 batch, the company has installed over 12,000 public WiFi hotspots in Nigeria with 500,000 users. The startup packages internet services drawing on partnerships with West African broadband provider MainOne and Facebook’s Express Wi-Fi

Tizeti raised a $3 million Series A round in 2018, led by 4DX Ventures, and has $5.1 million in investment from firms including Golden Palm Investments, YC, and Social Investments.

4DX Ventures co-founder Walter Baddoo sees Tizeti’s voice calling as a strategic extension of its connectivity business (noting WifiCall can be used with any IP).

“The core of the company’s mission is to bring down the cost of connectivity on the continent by leveraging mobile internet and data networks, WifiCall is a step in that direction” Baddoo told TechCrunch. “Africa is going to leapfrog a lot of the traditional call infrastructure…and WiFi calling…is giving individuals, small-businesses, and large businesses one-stop for much cheaper data-service alongside voice.”

Though Sub-Saharan Africa still stands last in most global rankings for smartphone adoption (33 percent) and internet penetration (35 percent), the continent continues to register among the fastest growth in the world for both.

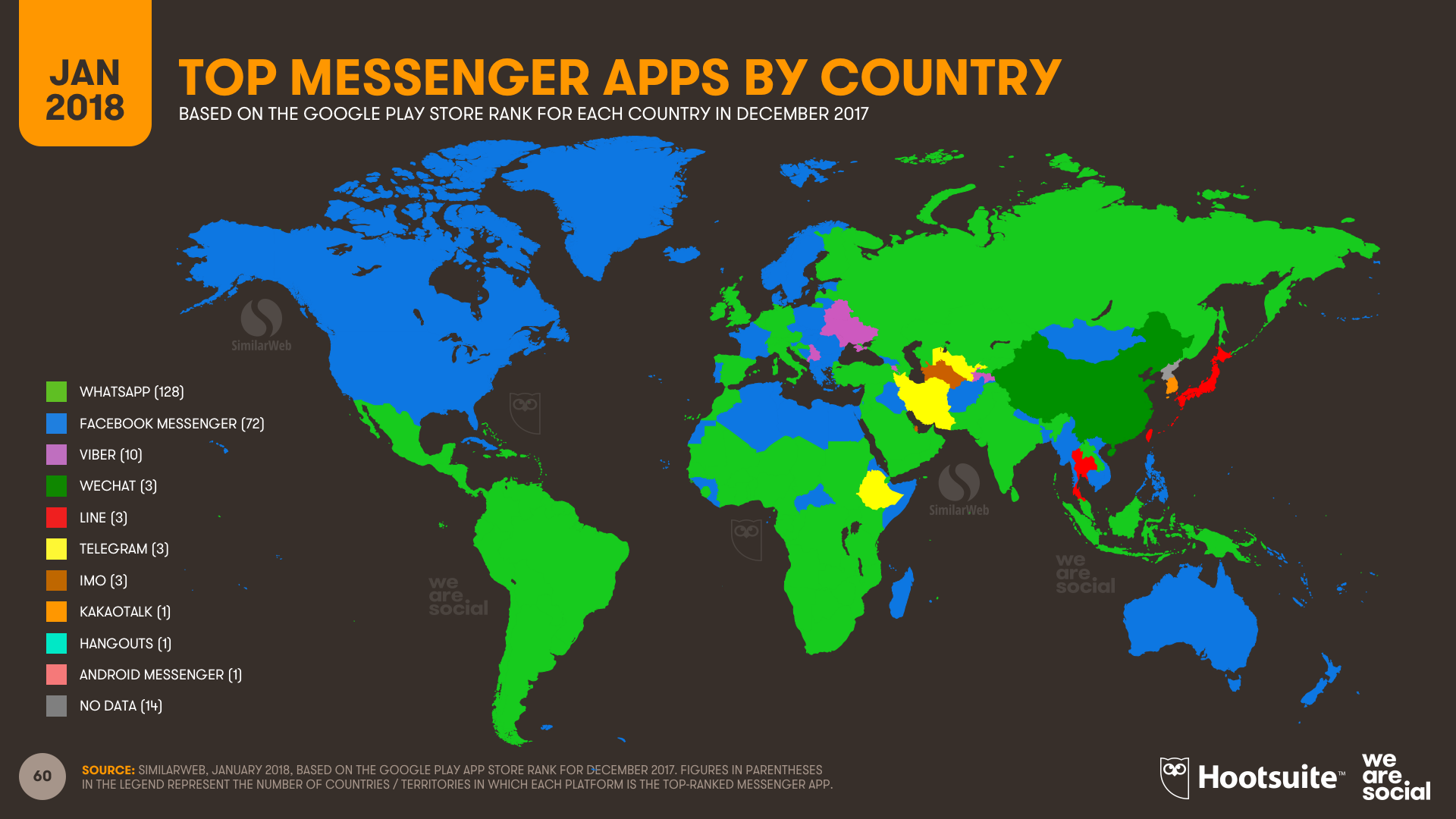

Mobile providers in Nigeria—such as MTN and Glo—are shifting customers from buying anonymous data-bundles to registered sim cards and subscription services. WiFi voice services are also commonly used across the continent for calls. Per We Are Social’s 2018 Digital Report, WhatsApp is the most downloaded messenger app across Africa.

On its internet service business, Tizeti has already expanded to Ghana with a consumer facing brand, Wifi-Africa, and looks to offer WifiCall there as soon as it gains regulatory approval—something in process, according to CEO Kendall Ananyi.

The startup is building an LTE network, to compliment its IP network, and plans to expand further into Nigeria with 5G offerings in the near future, according to Ananyi.

Tizeti also plans to open up its WifiCall product to phone numbers outside of Nigeria starting in 2020. “The way Africa skipped landlines and went straight to mobile, this is us saying the next level for our voice communications is to move toward voice IP networks,” Ananyi said.

Vault Platform, a London-based startup that has built software to “re-imagine” workplace misconduct reporting, has raised $4.2 million in seed funding. Leading the round is Kindred Capital, with participation from Angular Ventures, System.One, Jane VC, and ex-Mosaic Ventures Partner Mike Chalfen.

Founded in 2018 by Neta Meidav and Rotem Hayoun-Meidav, Vault is attempting to create a new and better way for company employees to report misconduct, such as workplace bullying or harassment, and in turn replace existing “hotline” systems, which it reckons are underused and often ineffective.

The so-called “TrustTech” offering lets employees easily record incidents in a diary-like space, with the option to only action those complaints when others also come forward. The SaaS consists of an employee app, corporate case management hub, and data and analytics. The latter claims to be able to help enterprises identify repeat problems and manage issues internally before they escalate.

“It’s undisputed that the world of work is going through a rapid change in light of the #MeToo and #TimesUp movements — we realised that one of the underlying reasons for this cultural revolution is the fact that reporting mechanisms are completely broken and what we really witness here is a deficit of trust,” Vault Platform co-founder and CEO Neta Meidav tells TechCrunch.

“Bullying and harassment are prevalent, however only 25 percent of misconduct is reported. This is a long-standing problem, but nowadays the risk lies with the enterprise not just the individual. Companies are waking up to the need of doing things differently”.

To tackle this, Meidav says Vault was created as an “employee-centric” platform that provides employees with a safe diary-like space to record incidents and save related evidence. If and when they choose to report it to their employer, they can do so by choosing “GoTogether,” a feature that allows them to file the report on the condition that they are not the only ones raising the same issues.

“GoTogether is a viable alternative to anonymous reporting, and it ensures that people are coming forward… with substantiated, evidence-based reports,” explains the Vault Platform CEO. “With the prevalent legacy hotline solution, abuse is much more of a possibility, since employees can just ‘tip’ anonymously without any accountability for what is being said”.

Meidav describe’s Vault Platform’s main competition as the “business as usual” solutions: anonymous reporting hotline operators that are traditionally the default for most employers. “They provide very little value for employees and employers beyond ticking the compliance and ethics box,” she says. “Alongside them, we compete with other startups who by large took the idea of anonymous reporting, digitised the same old methodology and turned it into an app”.

Meanwhile, Vault says it will use the funding to scale and expand its presence in North America and Europe. The company says target customers are organisations and enterprises from every sector and industry, typically with more than 1,000 employees. “Our client pipeline is varied, however, the most overwhelming interest has come so far from emerging tech companies,” adds Meidav.

Perkbox, the London-based startup now calling itself an “employee experience platform,” has raised a further £13.5 million in funding. The round is led by existing investor Draper Esprit, alongside a number of previous Perkbox angels. Prior to this, the company, which launched in 2015, had raised £11 million.

Targeting companies of all sizes, from SMEs to larger businesses, Perkbox’s platform lets employers give employees a number of benefits and rewards to enrich their work and personal life. The broader aim, of course, is to improve retention and staff well-being.

The offering now spans several products beyond its “perks” origins, including card-linked loyalty and medical provision. In addition, Perkbox enables companies to measure employee sentiment to help break down silos between management and teams, and to let employees give recognition to one another. This can either be peer-to-peer or top down from management.

“With this new suite of products, we transitioned from an employee ‘engagement’ platform to an employee ‘experience’ platform,” Perkobox co-founder and CEO Saurav Chopra tells me. “[All] with the aim of helping employers enrich the personal and working life of employees by catering for the full spectrum

of employee wellbeing: financial, physical and emotional”.

Headquartered in London but also with offices in Sheffield, Paris and Sydney, Perkbox says the new funding will be used to finance the company’s expansion operations in Australia and France.

longside this, it will invest in scaling the development and distribution of Perkbox’s new products: Perkbox Medical, Perkbox Insights and the platform’s card-linked PerksGo feature — all of which were launched late last year.

Remember Prisma? The Moscow-based team behind the app that sparked a style transfer craze in 2016 has raised a €6 million (~$6.7M) Series A, led by early stage artificial intelligence focused VC firm, Haxus.

While two of Prisma’s original co-founders left the company in the middle of last year, to work on building a new social app — the still, as yet, unreleased Capture — co-founder Andrey Usoltsev stayed on to keep developing Prisma Labs, taking up the CEO role.

The Series A funding will go towards expanding Prisma’s 21-strong team and scaling the business by spending on marketing to grow uptake of its apps’ premium subscription offers. These include a subscription layer for its eponymous app which gives users access to styles not available in the free version.

“We’re going to grow rapidly. We’re going to double our team this year and set up the impressive marketing budget,” says Usoltsev.

Late last year the team released a new freemium selfie retouching app, called Lensa, hoping to capture a slice of the beauty filter/photo-editing market. Their twist was to bake in AI smarts that power automatic adjustments — smoothing skin tone, whitening teeth, brightening eyes and so on, at the touch of the in-app camera button — as if by technomagic.

Their pitch for the selfie retoucher is ‘natural’ looking enhancements. And Prisma claims it’s seeing “very high” retention rates for Lensa, more akin to a sticky social network than photo-retouching software.

They argue the app’s face-retouching machine learning algorithms have benefited from the heap of data amassed from Prisma’s multi-millions of selfie-submitting users. And while there’s certainly no shortage of rival apps out there claiming to make selfies look better, Lensa’s AI-powered retouching does offer — at a glance — less crude/more plausible results than plenty of gimmicky ‘beauty filter’ apps also touting reality-editing wares.

“There is competition [for selfie retouching] and we think that it is good because it shows the size of the market,” says Usoltsev. “It’s huge. There are millions of people using apps like Facetune and what our advantage is is that we have a great technical team, R&D team that creates the best technology on the market in some areas… that trained building Prisma.

“We’re focusing on the quality and the natural look of the results. And some apps on the market didn’t pay as much attention as needed to these two things. We’re going to focus on this. We are not the first in this space but we are going to be the best in this space.”

“Automation is the key,” he adds. “We can now provide users with new kind of product, new kind of photo- and video-editors that automate the routine and requires less effort from the user side to get awesome results.”

Lensa, which launched in December with a subscription offering right off the bat, now has more than 100,000 users, according to Usoltsev — though it’s not breaking out paying subs yet.

The early userbase skews female and young — without, according to Usoltsev, Prisma doing any overt targeting — the main group being 18-24 year old women, somewhat unsurprisingly for a selfie beautifying app.

“The product is not viral, like Prisma, and most of the users are acquired from paid sources like Facebook ads and so on so. We strongly control the amount of users we acquire and now the product is not ready for the real scale,” he continues, noting they’re in the process of tweaking the app to expand the features and improve product market fit.

They’re also playing with the business model, with the initial subscription offering definitely feeling a bit underwhelming vs the core free AI-powered edits. (You can read our first look at Lensa here.)

“Right now we’re very close to start scaling it,” he adds. “We need a couple of more releases to be ready 100% and then we start scaling.

“We’re going to expand the range of features. We’re going to add a video feature because our primary feature — retouching — works in real-time and we tested it even on livestreaming and it works well. We’re working on optimizing it even more, to work faster, and in better quality.”

Other ongoing dev work to polish Lensa’s proposition includes tweaking the auto-adjustments it makes by determining the best settings for portrait-influencing factors, such as exposure, contrast, highlights and shadows. “For each adjustment we use a neural network,” he notes. “They work together… to find the best output result.”

Prisma is also monetizing its namesake original app — which grabbed around 70M downloads in a few months back in 2016, with Usoltsev saying they’re still relying mostly on organic/viral downloads rather than active promotion, riding the Prisma craze’s long viral tail.

They now have more than 100,000 paying subscribers for Prisma, though they’re not breaking out active usage — beyond saying it runs into the “millions”. (Back in 2017 they were reporting active monthly usage for the app of around 10M.) A premium sub offering was switched on in Prisma in January 2018.

“The paying audience is actually diverse. The major group by age I think it’s 24-35 year olds. And men and women is about the same proportion,” he adds.

Last year’s launch of Lensa came despite an earlier focus shift for the startup to b2b, after the style transfer craze that had powered its namesake app’s 2016 virality appeared on the cusp of being crazed (and, well, cloned) to death.

The plan, as it was in 2017, was for Prisma Labs to offer an SDK for computer vision-powered effects that developers could use to enhance their own apps. But the team kept its hand in the consumer space, maintaining their apps as testing grounds. A decision that set them up for what now looks a full reverse pivot back to consumer.

Usoltsev tells us the earlier b2b switch was “mostly” at the behest of Prisma’s investors — and wasn’t something the wider team was keen on.

They’re fully stoked to get back to their consumer roots, he adds.

“It didn’t really resonate with our team experience and our company DNA,” he adds of the b2b phase. “But in the process we figured out this is not what we want to do. We came up with the idea for the new product in the process and came up with the broader vision for the entire company and what we want to do.

“The core team was all about consumer products and b2b was not seen as interesting topic at all.”

So what’s on the slate for the future, as the team thinks about other features and/or consumer apps it might want to launch this year?

“Right now we’re thinking a lot about video,” he says. “Video is so fast growing space right now and we see a lot of new apps that break into the market — like TikTok — that grows insanely and based on video. And we’re going to provide users with automated tools to enhance their videos.

“Videos is more complicated to edit than photos because it requires more skill… to learn how to edit videos. And if your clip is longer than one minute it’s so hard to create it because montage could be a boring process and the longer the video is the more complicated the process is. So we’re going to fix this — and provide users with automated tools to help them create great videos quickly and with no effort, or as little as possible.”

AI-enabled auto video editing is “probably” going to be a standalone app, he says, rather than a feature baked into one of Prisma’s existing apps. But, well, watch this space.

Editor’s note: This post originally appeared on TechNode, an editorial partner of TechCrunch based in China.

It may have lost its original founding team, but the wheels are still rolling for embattled electric vehicle (EV) maker Faraday Future. The company, famous for lavish promotions but little substance, has received yet another financial lifeline in the wake of a dispute with key investor Evergrande.

Faraday announced on Monday that it had received $225 million in bridge financing. That sum is apparently part of a larger $1.25 billion capital raise that the company believes it can close before the end of this year. This latest shot in the arm is led by U.S. asset management firm Birch Lake Associates and it is aimed at bringing Faraday’s flagship FF91 SUV to market.

Part of the financing seeks to reassure Faraday’s suppliers after the financial turmoil the company has seen since late last year, and to “obtain their commitments” to ensure that the FF91 enters mass production. To secure the financing, Faraday said it had its intellectual property and technology valued — they are apparently worth $1.25 billion, it claimed.

This new financing comes hot on the heels of a joint venture (JV) with once-popular Chinese gaming company The9, which will bring Faraday’s V9 EV — a vehicle based on the FF91 — to market in China. Both companies will own 50 percent of the JV — The9 provided $600 million in capital to secure its share.

Faraday said that it expects the JV to reach an annual production capacity of 300,000 vehicles and begin selling cars by 2020. But, as we’ve seen often with this company, strategies don’t always go as planned.

Faraday was previously said to be in talks with EVAIO Blockchain over a possible $900 million in funding last November. Notably, the company has made no mention of the deal which suggests it didn’t materialize.

Faraday said on Monday it has a “growing fleet” of pre-production vehicles to test features for its FF91. The company has yet to enter mass production five years after its launch, mainly as a result of a series of financial issues that have ended in layoffs, unpaid wages, furloughs, property selloffs and much more. Faraday had previously planned to begin production of the FF91 at the end of 2018… but we are still waiting.

The company’s financing troubles began in 2017 but a new crisis emerged last year after a fallout with Evergrande. The Chinese real estate giant backed out of a proposed $2 billion investment deal with Faraday at the end of 2018 following an extended dispute over terms. Faraday had requested an advance on a future payment from Evergrande, a plea the Chinese company refused. Faraday then sought arbitration in Hong Kong.

The companies eventually settled the dispute, with Evergrande taking control over Faraday’s operations in China.

Faraday has since sought alternative investment. The EV maker has had to sell its headquarters in Los Angeles for around $10 million to stay above water. It has also put its 900-acre, $40 million property in Las Vegas up for sale.

In the midst of Faraday’s financial issues, the company also lost a number of its senior executives as a result of the “devastating impact” its troubles were having on company employees and the “ripple effect” on its suppliers and the industry.

With editing from Jon Russell

Samsung’s Q1 earnings are in and, as the company itself predicted, they don’t make for pretty reading.

The Korean giant saw revenue for the three-month period fall by 13 percent year-on-year to 52.4 trillion KRW, around $45 billion. Meanwhile, operating profit for Q1 2019 came in at 6.2 trillion KRW, that’s a whopping $5.33 billion but it represents a decline of huge 60 percent drop from the same period last year. Ouch.

Samsung’s Q1 last year was admittedly a blockbuster quarter, but these are massive declines.

What’s going on?

Samsung said that sales of its new Galaxy S10 smartphone were “solid” but it admitted that its memory chip and display businesses, so often the most lucrative units for the company, didn’t perform well and “weighed down” the company’s results overall. Despite those apparent S10 sales, the mobile division saw income drop “as competition intensified.” Meanwhile, the display business posted a loss “due to decreased demand for flexible displays and increasing market supplies for large displays.”

That’s all about on par with what analysts were expecting following that overly-optimistic Q1 earnings forecast made earlier this month.

The immediate future doesn’t look terribly rosy, too.

Samsung said the overall memory market will likely remain slow in Q2 although DRAM demand is expected to recover somewhat. It isn’t expecting too much to change for its display business, either, although “demand for flexible smartphone OLED panels is expected to rebound” which is where the company plans to place particular focus.

On the consumer side, where most readers know Samsung’s business better, Samsung expects to see improved sales in Q2, where buying is higher. It also teased a new Note, 5G devices — which will likely limited to Korea, we suspect — and that foldable phone.

The Galaxy Fold has been delayed after some journalists found issues with their review units — TechCrunch’s own Brian Heater was fine; he even enjoyed using it. There’s no specific mention in the quarterly report of a new launch date but it looks like the release will be mid-June, that’s assuming what AT&T is telling customers is accurate. But we’ll need to wait a few weeks for that to be confirmed, it seems.

Samsung says it will announce a revised launch date for the Galaxy Fold in the next few weeks.

Executives are speaking on a 1Q earnings conference call.— Tim Culpan (@tculpan) April 30, 2019

Southeast Asia’s startup ecosystem is set to get a massive injection of funds after Jungle Ventures reached a first close of $175 million for its newest fund, TechCrunch has come to learn.

Executives at the Singapore-based firm anticipate that the new fund, which is Jungle’s third to date, will reach a final close of $220 million over the coming few months, a source with knowledge of the fund and its plans told TechCrunch. If it were to reach that figure, the fund would become the largest for startup investments in Southeast Asia.

Jungle Ventures declined to comment.

An SEC filing posted in December suggested the firm was aiming to raise up to $200 million with the fund. Its last fund was $100 million and it closed in November 2016. Founding partners Anurag Srivastava and Amit Anand started the fund way back in 2012 when it raised a (much smaller) $10 million debut fund.

Digging a little deeper, our source revealed that the new Jungle fund includes returning LPs World Bank affiliate IFC and Cisco Investments — both of which invested in Jungle’s $18 million early-stage ‘SeedPlus’ fund — and Singapore sovereign fund Temasek. One new backer that we are aware of is German financier DEG although we understand that Jungle has spent considerable time fundraising in the U.S. market, hence the SEC filing. Beyond Europe and the U.S, the firm is also said to have pitched LPs in Asia — as you’d expect — and the Middle East.

Jungle is focused on Series A and Series B deals in Southeast Asia with the occasional investment in India or the rest of the world where it sees global potential. One such example of that is Engineer.ai, which raised $29.5 million last November in a round led by Jungle and Lakestar with participation from SoftBank’s AI unit DeepCore.

Jungle Ventures founding partners (left to right): Anurag Srivastava and Amit Anand

The meat and drink of the fund is Southeast Asia, and past investments there include cloud platform Deskera (most recent round $60 million), budget hotel network Reddoorz (raised $11 million last year), fintech startup Kredivo (raised $30 million last year) and digital fashion brand Pomelo, which has raised over $30 million from investors that also include JD.com.

In India, it has backed b2b sales platform Moglix and interior design startup Livspace among others. Past exits include Travelmob to HomeAway, Zipdial to Twitter, eBus to IMD and Voyagin to Rakuten.

We understand that the new fund has already completed five deals. Jungle’s pace of dealmaking is typically half a dozen investments per year, and we understand that will continue with fund three.

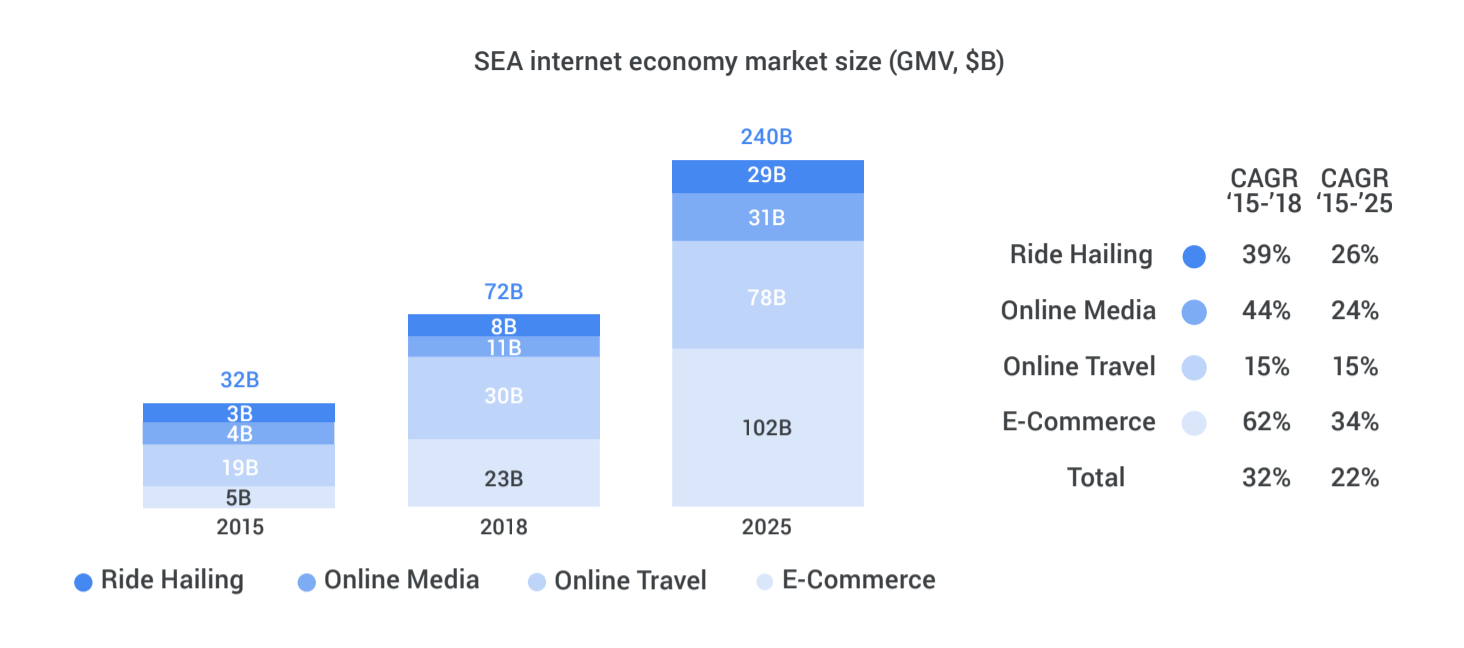

Executives at the fund are bullish on Southeast Asia, which is forecast to see strong growth economic growth thanks to increased internet access and digital spending. A much-cited report from Google and Temasek issued last year predicts that the region’s ‘digital economy’ will triple to reach $240 billion from 2025.

A 2018 report from Temasek and Google predicts significant growth in Southeast Asia’s digital economy

Other major VC funds in Southeast Asia include Vertex Ventures ($210 million fund), Golden Gate Ventures — $100 million and a $200 million growth fund — Openspace Ventures ($135 million), and EV’s $150 million growth fund.

There’s also B Capital from Facebook co-founder Eduardo Saverin which recently passed $400 million for the first close of its second fund, although that doesn’t invest exclusively in Southeast Asia, and Sequoia which has a $695 million fund for India and Southeast Asia. Other global names that you might see cutting deals in the region include Burda, which has a local presence and starts at Series B, TPG Global and KKR.

Update 04/29 19:50 PST: The original version of this article has been updated to correct that Jungle invests in around a dozen companies per year, not per month.

Alphabet’s Q1 earnings were a disappointment for Wall Street, courtesy primarily of ad revenue shortcomings. The hardware team met with some difficulties, as well, owing in part to a stagnating global smartphone market that has impacted virtually all players.

CEO Sundar Pichai cited “year over year headwinds” when referring to the company’s smartphone line, following the release of the Pixel 3 and Pixel 3 XL last fall. The executive rightly referenced the company’s relatively recent entry as a standalone hardware developer and painted a hopeful picture of the industry’s innovations going forward.

“I do continue to be excited to see 5G coming and the early foldable phones, which Android plays a big part in driving,” Pichai said on the call. Google has notably taken an important role developing an Android UI designed for the foldable form factor, along with working closely beside Samsung on its recently delayed foldable.

CFO Ruth Porat echoed Pichai’s comments, while hinting at what’s to come from the company. “While the first quarter results reflect pressure in the premium smartphone industry,” the exec explained, “we are pleased with the ongoing momentum of Assistant-enabled Home devices, particularly the Home Hub and Mini devices and look forward to our May 7 announcement at I/O from our hardware team.”

The reference to “premium smartphone[s]” looks to be a roundabout confirmation of the rumored Pixel 3a. The mid-tier take on the Pixel line is rumored to be a rare I/O hardware debut, coming next month. The arrival of such a device could go a ways toward helping jumpstart slowing sales for the line.

Pichai referenced the company’s newly opened “campus and engineering hub.” A result of the company’s massive deal with struggling handset maker, HTC, the Taipei R&D center will be primarily focused on Google’s smartphone offerings. He also referenced the company’s Amazon-competing Home line as a bright spot for its hardware offerings, particularly the Mini and Hub.

“If you take products like Google Home and Assistant products, we’ve been doing really well,” said Pichai. “We see strong momentum. We’re market leaders in the category, especially when you look at it on a global basis.”

We’re deep in IPO news, and last week was no different. When this happens, Equity’s Kate Clark and Alex Wilhelm fire up their mics and wax financial about the news we can’t possibly fit into the regular episode of the popular TechCrunch podcast.

Last week the duo discussed Uber’s IPO pricing and Slack’s S-1.

On Uber:

Kate: And before we jump into Uber’s Q1 financials, what do you think of Uber is most recent private valuation of 72 billion. Do you think that’s a wildly inflated valuation or do you think that’s a reasonable price tag?

Alex: So I have absolutely no idea. And we’re going to get into this a bit with the Q1 numbers, but I don’t know how to price this company. I really don’t. We talk a lot about SaaS IPOs and there’s a lot of really solid metrics out there about those companies and what they’re worth and what makes them work more or less than competitors. Uber’s a strange beast. It’s got these enormous losses. It’s got slowing growth. It is a global brand. It’s got an enormous amount of revenue. But where to put a price on it for me is a really big struggle. And this is why I’m glad that I’m a journalist and not an analyst because I don’t have to make that call.

On Slack:

Kate: I thought they were closer to profitability than they actually are and Slack is still losing a lot of money. So really it’s just like all the other unicorns who you’ve been covering who are not profitable and who are losing a lot of money, but Slack is a great business. So I think we’re going to see that play out. Actually. I kind of wish it was doing an IPO because it’s a lot more fun to speculate and criticize when we’re covering, direct listings yeah, they are so simple in so many ways and I think that’s what has appealed Spotify and Slack to that method of exit just because it does cut out a lot of that kind of especially unnecessary prices those companies have to pay, you save a lot of money doing it this way.

For access to the full transcription, become a member of Extra Crunch. Learn more and try it for free.

Twitter is unveiling a number of new content deals and renewals tonight at its NewFronts event for digital advertisers.

It’s only been two years since Twitter first joined the NewFronts. At the time, coverage suggested that executives saw the company’s video strategy as a crucial part of turning things around, but since then, the spotlight has moved on to other things (like rethinking the fundamental social dynamics of the service).

And yet the company is still making video deals, with 13 of them being unveiled tonight. That’s a lot of announcements, though considerably less than the 30 revealed at last year’s event. The company notes that it has already announced a number of partnerships this year, including one with the NBA.

“When you collaborate with the top publishers in the world, you can develop incredibly innovative ways to elevate premium content and bring new dimensions to the conversations that are already happening on Twitter,” said Twitter Global VP and Head of Content Partnerships Kay Madati in a statement. “Together with our partners, we developed this new slate of programming specifically for our audiences, and designed the content to fuel even more robust conversation on Twitter.”

Here’s a quick rundown of all the news:

Amazon announced today it has begun to ask customers to participate in a preview program that will help the company build a Spanish-language Alexa experience for U.S. users. The program, which is currently invite-only, will allow Amazon to incorporate into the U.S. Spanish-language experience a better understanding of things like word choice and local humor, as it has done with prior language launches in other regions. In addition, developers have been invited to begin building Spanish-language skills, also starting today, using the Alexa Skills Kit.

The latter was announced on the Alexa blog, noting that any skills created now will be made available to the customers in the preview program for the time being. They’ll then roll out to all customers when Alexa launches in the U.S. with Spanish-language support later this year.

Manufacturers who want to build “Alexa Built-in” products for Spanish-speaking customers can also now request early access to a related Alexa Voice Services (AVS) developer preview. Amazon says that Bose, Facebook and Sony are preparing to do so, while smart home device makers, including Philips, TP Link and Honeywell Home, will bring to U.S. users “Works with Alexa” devices that support Spanish.

Ahead of today, Alexa had supported Spanish language skills, but only in Spain and Mexico — not in the U.S. Those developers can opt to extend their existing skills to U.S. customers, Amazon says.

In addition to Spanish, developers have also been able to create skills in English in the U.S., U.K., Canada, Australia, and India; as well as in German, Japanese, French (in France and in Canada), and Portuguese (in Brazil). But on the language front, Google has had a decided advantage thanks to its work with Google Voice Search and Google Translate over the years.

Last summer, Google Home rolled out support for Spanish, in addition to launching the device in Spain and Mexico.

Amazon also trails Apple in terms of support for Spanish in the U.S., as Apple added support for Spanish to the HomePod in the U.S., Spain and Mexico in September 2018.

Spanish is a widely spoken language in the U.S. According to a 2015 report by Instituto Cervantes, the United States has the second highest concentration of Spanish speakers in the world, following Mexico. At the time of the report, there were 53 million people who spoke Spanish in the U.S. — a figure that included 41 million native Spanish speakers, and approximately 11.6 million bilingual Spanish speakers.

At the Open Infrastructure Summit, which was previously known as the OpenStack Summit, Canonical founder Mark Shuttleworth used his keynote to talk about the state of open-source foundations — and what often feels like the increasing competition between them. “I know for a fact that nobody asked to replace dueling vendors with dueling foundations,” he said. “Nobody asked for that.”

He then put a point on this, saying, “what’s the difference between a vendor that only promotes the ideas that are in its own interest and a foundation that does the same thing. Or worse, a foundation that will only represent projects that it’s paid to represent.”

Somewhat uncharacteristically, Shuttleworth didn’t say which foundations he was talking about, but since there are really only two foundations that fit the bill here, it’s pretty clear that he was talking about the OpenStack Foundation and the Linux Foundation — and maybe more precisely the Cloud Native Computing Foundation, the home of the incredibly popular Kubernetes project.

It turns out, that’s only part of his misgivings about the current state of open-source foundations, though. I sat down with Shuttleworth after his keynote to discuss his comments, as well as Canonical’s announcements around open infrastructure.

One thing that’s worth noting at the outset is that the OpenStack Foundation is using this event to highlight that fact that it has now brought in more new open infrastructure projects outside of the core OpenStack software, with two of them graduating from their pilot phase. Shuttleworth, who has made big bets on OpenStack in the past and is seeing a lot of interest from customers, is not a fan. Canonical, it’s worth noting, is also a major sponsor of the OpenStack Foundation. He, however, believes, the foundation should focus on the core OpenStack project.

“We’re busy deploying 27 OpenStack clouds — that’s more than double the run rate last year,” he said. “OpenStack is important. It’s very complicated and hard. And a lot of our focus has been on making it simpler and cleaner, despite the efforts of those around us in this community. But I believe in it. I think that if you need large-scale, multi-tenant virtualization infrastructure, it’s the best game in town. But it has problems. It needs focus. I’m super committed to that. And I worry about people losing their focus because something newer and shinier has shown up.”

To clarify that, I asked him if he essentially believes that the OpenStack Foundation is making a mistake by trying to be all things infrastructure. “Yes, absolutely,” he said. “At the end of the day, I think there are some projects that this community is famous for. They need focus, they need attention, right? It’s very hard to argue that they will get focus and attention when you’re launching a ton of other things that nobody’s ever heard of, right? Why are you launching those things? Who is behind those decisions? Is it a money question as well? Those are all fair questions to ask.”

He doesn’t believe all of the blame should fall on the Foundation leadership, though. “I think these guys are trying really hard. I think the common characterization that it was hapless isn’t helpful and isn’t accurate. We’re trying to figure stuff out.” Shuttleworth indeed doesn’t believe the leadership is hapless, something he stressed, but he clearly isn’t all that happy with the current path the OpenStack Foundation is on either.

The Foundation, of course, doesn’t agree. As OpenStack Foundation COO Mark Collier told me, the organization remains as committed to OpenStack as ever. “The Foundation, the board, the community, the staff — we’ve never been more committed to OpenStack,” he said. “If you look at the state of OpenStack, it’s one of the top-three most active open-source projects in the world right now […] There’s no wavering in our commitment to OpenStack.” He also noted that the other projects that are now part of the foundation are the kind of software that is helpful to OpenStack users. “These are efforts which are good for OpenStack,” he said. In addition, he stressed that the process of opening up the Foundation has been going on for more than two years, with the vast majority of the community (roughly 97 percent) voting in favor.

OpenStack board member Allison Randal echoed this. “Over the past few years, and a long series of strategic conversations, we realized that OpenStack doesn’t exist in a vacuum. OpenStack’s success depends on the success of a whole network of other open-source projects, including Linux distributions and dependencies like Python and hypervisors, but also on the success of other open infrastructure projects which our users are deploying together. The OpenStack community has learned a few things about successful open collaboration over the years, and we hope that sharing those lessons and offering a little support can help other open infrastructure projects succeed too. The rising tide of open source lifts all boats.”

As far as open-source foundations in general, he surely also doesn’t believe that it’s a good thing to have numerous foundations compete over projects. He argues that we’re still trying to figure out the role of open-source foundations and that we’re currently in a slightly awkward position because we’re still trying to determine how to best organize these foundations. “Open source in society is really interesting. And how we organize that in society is really interesting,” he said. “How we lead that, how we organize that is really interesting and there will be steps forward and steps backward. Foundations tweeting angrily at each other is not very presidential.”

He also challenged the notion that if you just put a project into a foundation, “everything gets better.” That’s too simplistic, he argues, because so much depends on the leadership of the foundation and how they define being open. “When you see foundations as nonprofit entities effectively arguing over who controls the more important toys, I don’t think that’s serving users.”

When I asked him whether he thinks some foundations are doing a better job than others, he essentially declined to comment. But he did say that he thinks the Linux Foundation is doing a good job with Linux, in large parts because it employs Linus Torvalds. “I think the technical leadership of a complex project that serves the needs of many organizations is best served that way and something that the OpenStack Foundation could learn from the Linux Foundation. I’d be much happier with my membership fees actually paying for thoughtful, independent leadership of the complexity of OpenStack rather than the sort of bizarre bun fights and stuffed ballots that we see today. For all the kumbaya, it flatly doesn’t work.” He believes that projects should have independent leaders who can make long-term plans. “Linus’ finger is a damn useful tool and it’s hard when everybody tries to get reelected. It’s easy to get outraged at Linus, but he’s doing a fucking good job, right?”

OpenStack, he believes, often lacks that kind of decisiveness because it tries to please everybody and attract more sponsors. “That’s perhaps the root cause,” he said, and it leads to too much “behind-the-scenes puppet mastering.”

In addition to our talk about foundations, Shuttleworth also noted that he believes the company is still on the path to an IPO. He’s obviously not committing to a time frame, but after a year of resetting in 2018, he argues that Canonical’s business is looking up. “We want to be north of $200 million in revenue and a decent growth rate and the right set of stories around the data center, around public cloud and IoT.” First, though, Canonical will do a growth equity round.

With news that the We Company (formerly known as WeWork) has officially filed to go public confidentially with the SEC today, there’s a big question on everyone’s mind: Is this the next massive startup win or a house of cards waiting to be toppled by the glare of the public markets?

No company I follow has as much polarized opinion as the We Company. And while the company will have to reveal at least some of its hand in its official S-1, my guess is that the polarization around the company will not be alleviated until well after it goes public, if ever.

The challenge with understanding its business is how much the details of each of its leases, real estate markets and tenants matter to its bottom line. We already know the top line numbers: the company had revenue of $1.8 billion in 2018, and a net loss of $1.9 billion that year. That led to the received opinion that the company has an extraordinarily weak business. As Crunchbase News editor Alex Wilhelm put it:

Mobile marketing company ManyChat has raised $18 million in Series A funding.

The startup, co-founded by CEO Mikael Yang, is currently focused on Facebook Messenger. It offers tools for creating a bot on Messenger while also supporting live human chatting (ManyChat says its approach is a “smart blend of automation and personal outreach”), and additional options like advertising to get more users to engage with your messaging channels.

ManyChat is just one of several startups hoping to build a business around Facebook Messenger bots, but this sounds like a product that businesses are actually using. The company says more than 1 million accounts have been created on the platform, with customers coming from e-commerce, traditional retail, gyms, beauty salons restaurants and more.

Those customers have collectively enlisted 350 million Messenger subscribers, and there are 7 billion messages sent on the platform each month. Plus, with an average open rate of 80 percent, these messages are actually being read.

The funding was led by Bessemer Venture Capital, with participation from Flint Capital. Bessemer’s Ethan Kurzweil is joining the board of directors, while the firm’s Alex Ferrara also becomes a board observer.

“ManyChat is at the forefront of a major shift in how businesses market to customers,” Kurzweil said in the funding announcement. “It’s not a matter of ‘if’ but ‘when’ email lists and static forms get replaced with a more personalized and conversational approach to customer engagement.”

He added that the company’s work with Messenger is “only the beginning”: “With Instagram, WhatsApp, RCS, and others on the horizon, there’s endless potential to scale.”