By BY NEIL VIGDOR AND AIMEE ORTIZ from NYT U.S. https://ift.tt/2YOqSIM

At least one House Democrat has had enough with Republicans ignoring mask requirements during House committee hearings. Rep. Jim Clyburn, head of the Select Subcommittee on the Coronavirus Crisis, has written a letter to ranking Republican Steve Scalise warning him that if committee Republicans continue to show up at hearings without masks, those Republicans will not be recognized to speak during subcommittee meetings. At all.

Clyburn was not particularly polite about it, either. In his letter, Clyburn reminds Scalise that it was Scalise who "repeatedly" has wanted in-person hearings and "you assured me that this could be done safely." But when "every single Republican Member of the Subcommittee refused to comply" with congressional mask rules, Clyburn was fed up.

"I was true to my word—I held this hearing in person, as you requested. Unfortunately, the Republican Members’ refusal to wear masks undermined the safety of everyone in the hearing room.

When in 2010, former VC Michael Kim set out to raise a fund that he would invest in a spate of micro VC managers, the investors to which he turned didn’t get it. Why pay Kim and his firm, Cendana Capital, a management fee on top of the management fees that the VC managers themselves charge?

Fast forward to today, and Kim has apparently proven to his backers that he’s worth the extra cost. Three years after raising $260 million across a handful of vehicles whose capital he plugged into up-and-coming venture firms, Kim is now revealing a fresh $278 million in capital commitments, including $218 million for its fourth flagship fund, and $60 million that Cendana will be managing expressly for the University of Texas endowment.

We talked with Kim last week about how he plans to invest the money, which differs slightly from how he has invested in the past.

Rather than stick solely with U.S.-based seed-stage managers who are raising vehicles of $100 million or less, he will split Cendana into three focus areas. One of these will remain seed-stage managers. A smaller area of focus — but one of growing importance, he said — is pre-seed managers who are managing $50 million or less and mostly funding ideas (and getting roughly 15% of each startup in exchange for the risk).

A third area of growing interest is in international managers. In fact, Kim says Cendana has already backed small venture firms in Australia (Blackbird Ventures), China (Cherubic Ventures, which is a cross-border investor that is also focused on the U.S.), Israel (Entree Capital), and India (Saama Capital), among other spots.

Altogether, Cendana is now managing around $1.2 billion. For its services, it charges its backers a 1% management fee and 10% of its profits atop the 2.5% management fee and 20% “carried interest” that his fund managers collect.

“To be extremely clear about it and transparent,” said Kim, “that’s a stacked fee that’s on top of what our [VC] fund managers charge. So Cendana LPs are paying 3.5% and 30%.” One “might think that seems pretty egregious,” he continued. “But a number of our LPs are either not staffed to go address this market or are too large to actually write smaller checks to these seed funds. And we provide a pretty interesting value proposition to them.”

That’s particularly true, Kim argues, when contrasting Cendana with other, bigger fund managers.

“A lot of these well-known fund of funds are asset gatherers,” he says. “They’re not charging carried interest. They’re in it for the management fee. They have shiny offices around the world, they have hundreds of people working at them, they’re raising billion-dollar-plus kind of funds, and they’re putting 30 to 50 names into each one, so in a way they become index funds. [But[ I don’t think venture is really an asset class. Unlike an ETF that’s focused on the S&P 500, venture capital is where a handful of fund managers capture most of the alpha. Our differentiation is that we’re taking we’re creating very concentrated portfolios.”

Specifically, Cendana typically holds positions in up to 12 funds, plus makes $1 million bets on another handful of more nascent managers that it will fund further if they prove out their theses.

Some of the managers it has backed has outgrown Cendana from an assets standpoint. It caps its investments in funds that are $100 million or less in size.

But over time, it has backed 22 managers over the years. Among them: 11.2 Capital, Accelerator Ventures, Angular Ventures, Bowery Capital, Collaborative Fund, Forerunner Ventures, Founder Collective, Freestyle Capital, IA Ventures, L2 Ventures, Lerer Hippeau, MHS Capital, Montage Ventures, Moxxie Ventures, Neo, NextView Ventures, Silicon Valley Data Capital, Spider Capital, Susa Ventures, Uncork VC (when it was still SoftTech VC), Wave Capital and XYZ Ventures.

As for its pre-seed fund managers, Cendana is now the anchor investors in 10 funds, including Better Tomorrow Ventures, Bolt VC, Engineering Capital, K9 Ventures, Mucker Capital, Notation Capital, PivotNorth Capital, Rhapsody Venture Partners, Root Ventures, and Wonder Ventures.

As for its returns, Kim says that Cendana’s very first fund, a $28.5 million vehicle, is “marked at north of 3x” and “that’s net of everything.”

He’s optimistic that the firm’s numbers will look even better over time. According to Kim, Cendana currently has 38 so-called unicorns in its broader portfolio. It separately hold stakes in 160 companies that are valued at more than $100 million.

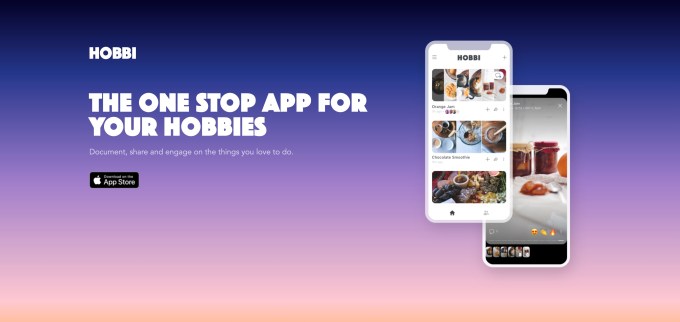

Facebook’s recently launched app, Hobbi, an experiment in short-form content creation around personal projects, hobbies, and other Pinterest-y content, is already shutting down. The app first arrived on iOS in February as one of now several launches from Facebook’s internal R&D group, the NPE Team.

Hobbi users have now been notified by way of push notification that the app is shutting down on July 10, 2020. The app allows users to export their data from its settings.

In the few months it’s been live on the U.S. App Store, Hobbi only gained 7,000 downloads, according to estimates from Sensor Tower. Apptopia also reported the app had under 10K downloads and saw minimal gains during May and June.

Though Hobbi clearly took cues from Pinterest, it was not designed to be a pinboard of inspirational ideas. Instead, Hobbi users would organize photos of their projects — like gardening, cooking, arts & crafts, décor, and more — in a visual diary of sorts. The goal was to photograph the project’s progress over time, adding text to describe the steps, as needed.

The end result would be a highlight reel of all those steps that could be published externally when the project was completed.

But Hobbi was a fairly bare bones app. There was nothing else to do but document your own projects. You couldn’t browse and watch projects other users had created, beyond a few samples, nor could you follow top users across the service. And even the tools for documentation were underdeveloped. Beyond a special “Notes” field for writing down a project’s steps, the app experience felt like a watered-down version of Stories.

Image Credits: Hobbi

Facebook wasn’t alone in pursuing the potential of short-form creative content. Google’s internal R&D group, Area 120, also published its own experiment in this area with the video app Tangi. And Pinterest was recently spotted testing a new version of Story Pins, that would allow users to showcase DIY and creative content in a similar way.

It’s not surprising to see Hobbi wind down so quickly, given its lack of traction. Facebook already said its NPE Team experiments would involve apps that changed very rapidly and would shut down if consumers didn’t find them useful.

In addition to Hobbi, the NPE Team has launched a number of apps since last summer, including meme creator Whale, conversational app Bump, music app Aux, couples app Tuned, Apple Watch app Kit, audio calling app CatchUp, collaborative music app Collab, live event companion Venue, and predictions app Forecast. Before Hobbi, the only one to have shut down was Bump. (Some are not live in the U.S., either.)

Of course, Facebook may not intend to use these experiments to create a set of entirely new social apps built from the ground-up. Instead, it’s likely looking to collect data about what features resonate with users and how different creation tools are used. This is data that can inform Facebook’s development of features for its main set of apps, like Facebook, Messenger, WhatsApp and Instagram.

We’ve reached out to Facebook for comment but one had not been provided at the time of publication.

Lyft’s self-driving vehicle division has restarted testing on public roads in California, several months after pausing operations amid the COVID-19 pandemic.

Lyft’s Level 5 program said Tuesday some of its autonomous vehicles are back on the road in Palo Alto and at its closed test track. The company has not resumed a pilot program that provided rides to Lyft employees in Palo Alto.

The company said it is following CDC guidelines for personal protective equipment and surface cleaning. It has also enacted several additional safety steps to prevent the spread of COVID. Each autonomous test vehicle is equipped with partitions to separate the two safety operators inside, the company said. The operators must wear face shields and submit to temperature checks. They’re also paired together for two weeks at a time.

Lyft’s Level 5 program — a nod to the SAE automated driving level that means the vehicle handles all driving in all conditions — launched in July 2017 but didn’t starting testing on California’s public roads until November 2018. Lyft then ramped up the testing program and its fleet. By late 2019, Lyft was driving four times more autonomous miles per quarter than it was six months prior.

Lyft had 19 autonomous vehicles testing on public roads in California in 2019, according to the California Department of Motor Vehicles, the primary agency that regulates AVs in the state. Those 19 vehicles, which operated during the reporting period of December 2018 to November 2019, drove nearly 43,000 miles in autonomous mode, according to Lyft’s annual report released in February. While that’s a tiny figure when compared to other companies such as Argo AI, Cruise and Waymo, it does represent progress within the program.

Lyft has supplemented its on-road testing with simulation, a strategy that it relied on more heavily during COVID-related shutdowns. And it will likely continue to lean on simulation even as local governments lift restrictions and the economy reopens.

Simulation is a cost-effective way to create additional control, repeatability and safety, according to a blog post released Tuesday by Robert Morgan, director of engineering, and Sameer Qureshi, director of product management at Level 5. The pair said simulation has also allowed the Level 5 unit to test its work without vehicles, without employees leaving their desks and, for the last few months, without leaving their homes. Level 5 employs more than 400 people in London, Munich and the United States.

Using simulation in the development of autonomous vehicle technology is a well-established tool in the industry. Lyft’s approach to data — which it uses to improve its simulations — is what differentiates the company from competitors. Lyft is using data collected from drivers on its ride-hailing app to improve simulation tests as well as build 3D maps and understand human driving patterns.

The Level 5 program is taking data from select vehicles in Lyft’s Express Drive program, which provides rental cars and SUVs to drivers on its platform as an alternative to options like long-term leasing.

Uber has reportedly made an offer to buy food delivery service Postmates, according to The New York Times.

According to the Times, the talks are still ongoing and the deal could fall through.

For those that have been paying attention to Uber, this appetite is not new, albeit consistent. A little over a month ago, the ride-hailing company was reportedly pursuing an acquisition of Grubhub, another food delivery company. Grubhub was ultimately acquired by Just Eat Takeaway in a $7.3 billion deal, but only after the deal with Uber fell through over a variety of concerns.

Food delivery market has set to benefit largely from the COVID-19 pandemic, as stores remain shuttered or switch operations to takeout only. Latest earnings from the public ride-hailing company show that its ride-hailing business is slowing while its food delivery service is growing like hell. Gross bookings for Uber Eats last quarter were $4.68 billion.

So even though Uber still loses a ton of money ($2.94 billion including all costs), its Uber Eats growth is staggering. And the green shoots might be fueling some of this interest in other competitors.

If regulatory concerns were an issue, Postmates may make a better fit.

With a valuation of $2.4 billion, Postmates is significantly smaller than Grubhub. And while the company filed to go public nearly 16 months ago, it held off eventually citing “choppy market” conditions.

So if Uber Eats and Postmates combined, the result would still be smaller than Doordash’s market hold, but would be competitive nonetheless. DoorDash, last valued at $13 billion, confidentially filed for an IPO nearly four months ago.

Also, Postmates delivers more than just food.

If the merger goes through, the food delivery race would get refueled in an interesting way: Uber Eats and Postmates versus Grubhub and Takeaway versus DoorDash .

Postmates declined to comment on rumors or speculation. Uber did not immediately respond to a request for comment.

Jeffrey Miller, Colorado State University

In January 2015, food sales at restaurants overtook those at grocery stores for the first time. Most thought this marked a permanent shift in the American meal.

Thanks to the coronavirus pandemic, that trend took a U-turn. Restaurant revenue cratered, while shoppers emptied grocery shelves stocking up on food to cook at home. And with sales of pantry items soaring, shoppers found themselves reaching for an old reliable.

In April, sales of Kraft macaroni and cheese were up 27% from the same time last year. General Mills, the maker of Annie’s mac and cheese, has seen a similar bump.

The United States government began measures today to end its special status with Hong Kong, one month after Secretary of State Michael Pompeo told Congress that Hong Kong should no longer be considered autonomous from China. These include suspending export license exceptions for sensitive U.S. technology and ending the export of defense equipment to Hong Kong. Both the Commerce and State Departments also said further restrictions are being evaluated.

The U.S. government’s announcements were made a few hours before news broke that China had passed a new national security law that will give it greater control over Hong Kong. It is expected to take effect on July 1, according to the South China Morning Post.

The term “special status” refers to arrangements that recognized the difference between Hong Kong and mainland China under the “one country, two systems” policy put into place when the United Kingdom handed control of Hong Kong back to Beijing in 1997. These included different export controls, immigration policies and lower tariffs. But that preferential treatment was put into jeopardy after China proposed the new national security law, which many Hong Kong residents fear will end the region’s judicial independence from Beijing.

The U.S Commerce Department and State Department issued separate statements today detailing the new restrictions on Hong Kong. Secretary of Commerce Wilbur Ross said the Commerce Department will suspend export license exceptions for sensitive U.S. technology, and that “further actions to eliminate differential treatment are also being evaluated.”

The State Department said that it will end exports of U.S. defense equipment and also “take steps toward imposing the same restrictions on U.S. defense and dual-use technologies to Hong Kong as it does for China.”

In a statement to Reuters, Kurt Tong, a former U.S. consul general in Hong Kong, said that the U.S. government’s decisions today would not impact a large amount of trade between the U.S. and Hong Kong because the territory is not a major manufacturing center and its economy is mostly services.

According to figures from the Office of the United States Trade Representative, Hong Kong accounted for 2.2% of overall U.S. exports in 2018, totaling $37.3 billion, with the top export categories being electrical machinery, precious metal and stones, art and antiques, and beef. But the new restrictions could make more difficult for U.S. semiconductor and other technology companies to do business with Hong Kong clients.

Other restrictions proposed by the United States including ending its extradition treaty with Hong Kong.

Both the State and Commerce departments said that the restrictions were put into place for national security reasons. “We can no longer distinguish between the export of controlled items to Hong Kong or to mainland China,” Pompeo wrote. “We cannot risk these items falling into the hands of the People’s Liberation Army, whose primary purpose is to uphold the dictatorship of the CCP by any means necessary.”

In his statement, Ross said, “With the Chinese Communist Party’s imposition of new security measures on Hong Kong, the risk that sensitive U.S. technology will be diverted to the People’s Liberation Army or Ministry of State Security has increased, all while undermining the territory’s autonomy.”

Despite the Wirecard fallout, German fintech startup solarisBank has raised a Series C funding round of $67.5 million (€60 million). Following today’s funding round, solarisBank is now valued at $360 million (€320 million). solarisBank doesn't have any consumer product directly. Instead, it offers financial services to other fintech companies through a set of APIs.

With solarisBank, you can build a fintech startup and leverage solarisBank’s line of products to do the heavy lifting. It’s an infrastructure company in the banking space.

While solarisBank might not be a familiar name, some of its clients have become quite popular. They include challenger banks, such as Tomorrow, Insha and a newcomer called Vivid, business banking startups, such as Penta and Kontist, trading app Trade Republic, cryptocurrency startups Bison and Bitwala, etc.

Overall, solarisBank works with 70 companies that have attracted 400,000 clients in total.

HV Holtzbrinck Ventures is leading the round with existing investor yabeo committing a substantial follow-on investment. Other new investors include Vulcan Capital, Samsung Catalyst Fund and Storm Ventures. Existing investors BBVA, SBI Group, ABN AMRO Ventures, Global Brain, Hegus and Lakestar are investing again.

The company started the fundraising process back in December. Due to the economic prospects, it has been a mixed process. “A lot of investors looked at their portfolio companies and the appetite to look at something new was not there,” solarisBank CEO Roland Folz told me. But everything worked out eventually as around half of the funding comes from existing investors.

“We originally were looking for €40 million but we were overwhelmed by the interest of investors in spite of Covid,” solarisBank Head of Strategy and Shareholder Relations Layla Qassim told me.

solarisBank’s vision could be summed up in two words — regulation and modularity. The company is a fully licensed bank, which means that its clients don’t have to apply to a banking license themselves.

And the startup lets you pick the modules that you want to use for your product. Maybe you’re building a mobile cryptocurrency wallet and you just want to be able to give an IBAN and a debit card to your users. Maybe you’re building a used car marketplace like CarNext and you want to offer credit. Maybe you want to build a challenger bank but address a specific vertical.

With solarisBank, you can open bank accounts and issue payment cards attached to those accounts. You can also issue cards and attach them to a different account in case you’re integrating with existing bank accounts. The startup also offers various services around payments, vouchers, cross-border transactions and more.

More recently, the company launched a new feature called Splitpay with American Express. When customers check out on an e-commerce platform in Germany, American Express customers will be able to choose a repayment plan to pay over multiple months.

solarisBank generates revenue from its clients as they pay to use the company’s APIs and enable accounts and cards. solarisBank also collects the interchange fees on card transactions and share revenue with its clients. Similarly, solarisBank can offer to share revenue on credit interests with its clients.

In the future, solarisBank plans to make its portfolio of financial services even more compelling by introducing local IBANs in the most important European markets. It should make it easier to convince potential clients outside of Germany to use solarisBank as their banking infrastructure.

Chris Hayes was pissed last week. He raged at the Trump administration’s many failures. People have made tremendous sacrifices for months and his government still doesn’t have the testing and contact tracing capacity we need.

His guest, former Health and Human Services Secretary Donna Shalala, spoke about the disaster in Florida and brought up just how bad our contact tracing is.

9,000 new cases in one day. 29,000 in the last seven days. It’s a disaster. It’s a catastrophic failure of leadership. Of our Governor, of our President. The mayors are scrambling to try to do the right thing.

We don’t have contact tracers as you pointed out. Listen. Rwanda, in Africa, has 12 million people. They have 60,000 contact tracers. We’re not even in the ball game.

I've been writing about contact tracing issues since the beginning of this pandemic. I wrote "Let's Track The COVIDIOT Protesters" back in April. By now I thought I'd be writing about privacy concerns in a national database. But it hasn't been implemented because of another massive failure of Trump admin.

While many in Silicon Valley might prefer to forget about investor Mike Rothenberg roughly four years after his young venture firm began to implode, his story is still being written, and the latest chapter doesn’t bode well for the 36-year-old.

While Rothenberg earlier tangled with the Securities & Exchange Commission and lost, it was a civil matter, if one that could haunt him for the rest of his life.

Now, the U.S. Department of Justice has brought two criminal wire fraud charges against him, charges that he made two false statements to a bank, and money laundering charges, all of which could result in a very long time in prison depending on how things play out.

How long, exactly? The DOJ says the the two bank fraud charges and the two false statement to a bank charges “each carry a maximum of 30 years in prison, not more than five years supervised release, and a $1,000,000 fine,” while the money laundering charges “carry a penalty of imprisonment of not more than ten years, not more than three years of supervised release, and a fine of not more than twice the amount of the criminally derived property involved in the transaction at issue.”

The damage done in the brief life of his venture outfit — even while understood in broad strokes by industry watchers – is rather breathtaking. As laid out by the DOJ, Rothenberg raised and managed four funds between the inception of his firm, Rothenberg Ventures, in 2013 and 2016, and his criminal activities began almost immediately.

According to the DOJ’s charges, after closing that initial fund, he partially funded his own capital commitment to the second fund by making false statements about his wealth to his bank while refinancing his home mortgage and while obtaining a $300,000 personal loan, some of which he poured in the fund.

That’s bank fraud. Yet according to the DOJ, that was merely Rothenberg’s opening gambit.

The following year, in 2015, Rothenberg “took excess money in venture capital fees from one of the funds he was raising and managing” and because he then “faced a shortfall at the end of the year that he did not wish to report to his investors,” he found an illegal workaround. Specifically, alleges the DOJ, he “engaged in a scheme to defraud a bank by making false statements and misrepresentations to the bank in order to obtain a $4 million line of credit to pay back the fund from which he had taken excess fees.” The idea, says the DOJ, was to “deceive his investors into believing the fund was well-managed,” which apparently worked at the time.

Of course, in reality, Rothenberg was digging an ever bigger hole for himself, suggests the DOJ. Meanwhile, he seemingly had appearances to keep up. Which could be why in February 2016, according to the allegations laid out by the DOJ, he “engaged in a scheme to defraud an investor with respect to a $2 million investment that it believed it was making directly into a virtual reality content production company operating as River Studios that Rothenberg contended he wholly owned.”

The DOJ says that that instead, Rothenberg used most of it for purposes having nothing to do with that production company.

Rothenberg also — judging by the DOJ’s report — began to throw caution to the wind, perhaps because he thought he might get away with it or because he was increasingly desperate.

To wit, its complaint alleges that five months after defrauding that first investor, in July 2016, Rothenberg “engaged in a scheme to defraud as many as five separate investors when he induced them to wire a total of $1.35 million under the premise of investing in the untraded stock of a privately-held software company.” The complaint charges Rothenberg with “knowingly engaging in a scheme to defraud one investor by representing to that organization that its money would be used to purchase the software company’s shares. According to the complaint, on the same day the money was wired, Rothenberg took the money from the bank account designed to make the investment and sent it to RVMC’s main operating bank account, from which it was used for many purposes.”

No stock in the software company was ever purchased, according to the DOJ’s investigation. The agency says Rothenberg also “induced investments in his RVMC-managed funds under the premise he would use the money for investments in ‘frontier edge’ technologies and take only certain limited fees for the management of the funds.” Instead, he “took more fees than to which he was entitled and invested far less of the money he raised than the operating agreements disclosed to the investors contemplated.”

Altogether, says the DOJ, it has collected evidence that Rothenberg fraudulently obtained at least $18.8 million.

We’ve reached out to Rothenberg — who has consistently denied any wrongdoing — for comment. It isn’t the only bad news he has faced lately, in any case.

Just seven months ago, in December, Rothenberg was ordered to pay more than $31 million in connection with the misappropriation of investor money relating to an SEC complaint that alleged he misappropriated millions of dollars from his firm’s funds, then used the money to support personal business ventures.

In October 2018, Rothenberg also agreed to be barred from the securities industry with a right to reapply after five years.

All have been incredible developments in what was already a nearly unbelievable story of apparent hubris and its consequences. Rothenberg had entered the venture scene with a splash, landing a feature story in TechCrunch, in early 2013, and touting his connections and his youth — he was 27 at the time — as advantages he enjoyed over older VCs who might not have a shot at the same companies.

Two years later, BusinessWeek dubbed him Silicon Valley’s “party animal,” as his firm became renowned in the Bay Area for “throwing bashes for entrepreneurs,” including expensive parties at San Francisco’s Oracle Park baseball field (known at the time as AT&T Park). Rothenberg, a self-described former math Olympian who attended Stanford before getting an MBA from Harvard Business School, said at the time, “The way we build a scalable network is by hosting a lot of events.”

He seemed to dismiss questions about how they were paid for, but he did tell BusinessWeek that he provided some of the earliest funding to Robinhood, the stock-trading app that was most recently valued at $7.6 billion and whose cofounders and CEOs attended Stanford at the same time as Rothenberg.

It was an auspicious start, in short. Alas, by the summer of 2016, the firm’s employees were scattering to the winds, and investigators were beginning to take notes.

E-commerce giant Flipkart is planning to launch a hyperlocal service that would enable customers to buy items from local stores and have those delivered to them in an hour and a half or less. Yatra, an online travel and hotel ticketing service, is exploring a new business line altogether: Supplying office accessories.

Flipkart and Yatra are not the only firms eyeing new business categories. Dozens of firms in the country have branched out by launching new services in recent weeks, in part to offset the disruption the COVID-19 epidemic has caused to their core offerings.

Swiggy and Zomato, the nation’s largest food delivery startups, began delivering alcohol in select parts of the country last month. The move came weeks after the two firms, both of which are seeing fewer orders and had to let go hundreds of employees, started accepting orders for grocery items in a move that challenged existing online market leaders BigBasket and Grofers.

Udaan, a business-to-business marketplace, recently started to accept bulk orders from some housing societies and is exploring more opportunities in the business-to-commerce space, the startup told TechCrunch.

These shifts came shortly after New Delhi announced a nationwide lockdown to contain the spread of the coronavirus. The lockdown meant that all public places including movie theaters, shopping malls, schools, and public transport were suspended.

Instead of temporarily halting their businesses altogether, as many have done in other markets, scores of startups in India have explored ways to make the most out of the current unfortunate spell.

“This pandemic has given an opportunity to the Indian tech startup ecosystem to have a harder look at the unit-economics of their businesses and become more capital efficient in the shorter and longer-term,” Puneet Kumar, a growth investor in Indian startup ecosystem, told TechCrunch in an interview.

Of the few things most Indian state governments have agreed should remain open include grocery shops, and online delivery services for grocery and food.

People buy groceries at a supermarket during the first day of the 21-day government-imposed nationwide lockdown as a preventive measure against the spread of the COVID-19 coronavirus, in Bangalore on March 25, 2020. (Photo by MANJUNATH KIRAN/AFP via Getty Images)

E-commerce firms Snapdeal and DealShare began grocery delivery service in late March. The move was soon followed by social-commerce startup Meesho, fitness startup Curefit, and BharatPe, which is best known for facilitating mobile payments between merchants and users.

Meesho’s attempt is still in the pilot stage, said Vidit Aatrey, the Facebook-backed startup’s co-founder and chief executive. “We started grocery during the lockdown to give some income opportunities to our sellers and so far it has shown good response. So we are continuing the pilot even after lockdown has lifted,” he said.

ClubFactory, best known for selling low-cost beauty items, has also started to deliver grocery products, and so has NoBroker, a Bangalore-based startup that connects apartment seekers with property owners. And MakeMyTrip, a giant that provides solutions to book flight and hotel tickets, has entered the food delivery market.

Another such giant, BookMyShow, which sells movie tickets, has in recent weeks rushed to support online events, helping comedians and other artists sell tickets online. The Mumbai-headquartered firm plans to make further inroads around this business idea in the coming days.

For some startups, the pandemic has resulted in accelerating the launch of their product cycles. CRED, a Bangalore-based startup that is attempting to help Indians improve their financial behavior by paying their credit card bill on time, launched an instant credit line and apartment rental services.

Kunal Shah, the founder and chief executive of CRED, said the startup “fast-tracked the launch” of these two products as they could prove immensely useful in the current environment.

For a handful of startups, the pandemic has meant accelerated growth. Unacademy, a Facebook-backed online learning startup, has seen its user base and subscribers count surge in recent months and told TechCrunch that it is in the process of more than doubling the number of exam preparation courses it offers on its platform in the next two months.

Since March, the number of users who access the online learning service each day has surged to 700,000. “We have also seen a 200% increase in viewers per week for the free live classes offered on the platform. Additionally there has been a 50% increase in paid subscribers and over 50% increase in average watchtime per day among our subscribers,” a spokesperson said.

As with online learning firms, firms operating on-demand video streaming services have also seen a significant rise in the number of users they serve. Zee5, which has amassed over 80 million users, told TechCrunch last week that in a month it will introduce a new category in its app that would curate short-form videos produced and submitted by users. The firm said the feature would look very similar to TikTok.

The pandemic “has also accelerated the adoption of online services in India across all demographics. Many who would not have considered buying goods and services online are starting to adopt the online platforms for basic necessities at a faster pace,” said venture capitalist Kumar.

“As far as expansion into adjacent categories is concerned, some of this was a natural progression and startups were slowly moving in that direction anyway. The pandemic has forced people to get there faster.”

Roosh, a Mumbai-based game developing firm founded by several industry veterans, launched a new app ahead of schedule that allows social influencers to promote games on platforms such as Instagram and TikTok, Deepak Ail, co-founder and chief executive of Roosh, told TechCrunch.

ShareChat, a Twitter-backed social network, recently acquired a startup called Elanic to explore opportunities in social-commerce. OkCredit, a bookkeeping service for merchants, has been exploring ways to allow users to purchase items from neighborhood stores.

And NowFloats, a Mumbai-based SaaS startup that helps businesses and individuals build an online presence without any web developing skills, is on-boarding doctors to help people consult with medical professionals.

Startups are not the only businesses that have scrambled to eye new categories. Established firms such as Carnival Group, which is India’s third-largest multiplex theatre chain, said it is foraying into cloud kitchen business.

Amazon, which competes with Walmart’s Flipkart in India, has also secured approval from West Bengal to deliver alcohol in the nation’s fourth most populated state. The e-commerce giant is also exploring ways to work with mom and pop stores that dot tens of thousands of cities and towns of India.

Last week, the American giant launched “Smart Stores” that allows shoppers to walk to a participating physical store, scan a QR code, and pick and purchase items through the Amazon app. The firm, which is supplying these mom and pop stores with software and QR code, said more than 10,000 shops are participating in the Smart Stores program.