By BY GILLIAN R. BRASSIL from NYT Sports https://ift.tt/3p9U6NP

Desi Lydic of The Daily Show takes a look at the Girl Scouts of America and how they're helping girls learn to break through the glass ceiling.

Open thread below...

Today Blue America is endorsing a proven and effective champion of the working class and of all people who are oppressed, the great Nina Turner. And when have you ever heard me use the word "great" to describe a candidate Blue America is endorsing? Nina really is. You want to see a more functional progressive movement inside Congress? I'm counting on Nina.

This Blue America 2022 congressional thermometer is how you can contribute to her campaign. Just tap on it; it's a hot link.

This Blue America 2022 congressional thermometer is how you can contribute to her campaign. Just tap on it; it's a hot link.

Ohio's 11th congressional district is extremely gerrymandered and misshapen-- a D+30 district that was drawn by the Republican legislature to scoop up as many likely Democratic voters in the region as possible, making OH-14, OH-16 and OH-07 safe for Republicans. Trump lost OH-11 in a landslide-- 19.2%.

Zenyum, a startup that wants to make cosmetic dentistry more affordable, announced today it has raised a $40 million Series B. This includes $25 million from L Catterton, a private equity firm focused on consumer brands. The round’s other participants were Sequoia Capital India (Zenyum is an alum of its Surge accelerator program), RTP Global, Partech, TNB Aura, Seeds Capital and FEBE Ventures. L Catteron Asia’s head of growth investments, Anjana Sasidharan, will join Zenyum’s board.

This brings Zenyum’s total raised so far to $56 million, including a $13.6 million Series A announced in November 2019. In a press statement, Sasidharan said, “Zenyum’s differentiated business model gives it a strong competitive advantage, and we are excited to partner with the founder management team to help them realize their growth ambitions.” Other dental-related investments in L Catteron’s portfolio include Ideal Image, ClearChoice, dentalcorp, OdontoCompany, Espaçolaser and 98point6.

Founded in 2018, the company’s products now include ZenyumSonic electric toothbrushes; Zenyum Clear, or transparent 3D-printed aligners; and ZenyumClear Plus for more complex teeth realignment cases.

Founder and chief executive officer Julian Artopé told TechCrunch that ZenyumClear aligners can be up to 70% cheaper than other braces, including traditional metal braces, lingual braces and other clear aligners like Invisalign, depending on the condition of a patients’ teeth and what they want to achieve. Zenyum Clear costs $2,400 SGD (about $1,816 USD), while ZenyumClear Plus ranges from $3,300 to $3,900 SGD (about $2,497 to $2,951 USD).

The company is able to reduce the cost of its invisible braces by combining a network of dental partners with a technology stack that allows providers to monitor patients’ progress while reducing the number of clinic visits they need to make.

First, potential customers send a photo of their teeth to Zenyum to determine if ZenyumClear or ZenyumClear Plus will work for them. If so, they have an in-person consultation with a dentists, including an X-ray and 3D scan. This costs between $120 to $170 SGD, which is paid to the clinic. After their invisible braces are ready, the patient returns to the dentist for a fitting. Then dentists can monitor the progress of their patient’s teeth through Zenyum’s app, only asking them to make another in-person visit if necessary.

ZenyumClear is currently available in Singapore, Malaysia, Indonesia, Hong Kong, Macau, Vietnam, Thailand and Taiwan, with more markets planned.

Sequoia India principal Pieter Kemps told TechCrunch, “There are 300M customers in Zenyum’s core markets—Southeast Asia, Hong Kong, Taiwan—who have increased disposable income for beauty. We believe spend on invisible braces will grow significantly from the current penetration, but what it requires is strong execution on a complex product to become the preferred choice for consumers. That is where Zenyum shines: excellent execution, leading to new products, best-in-class NPS, fast growth, and strong economics. This Series B is a testament to that, and of the belief in the large opportunity down the road.”

Cookie pop-ups getting you down? Complaints that the web is ‘unusable’ in Europe because of frustrating and confusing ‘data choices’ notifications that get in the way of what you’re trying to do online certainly aren’t hard to find.

What is hard to find is the ‘reject all’ button that lets you opt out of non-essential cookies which power unpopular stuff like creepy ads. Yet the law says there should be an opt-out clearly offered. So people who complain that EU ‘regulatory bureaucracy’ is the problem are taking aim at the wrong target.

EU law on cookie consent is clear: Web users should be offered a simple, free choice — to accept or reject.

The problem is that most websites simply aren’t compliant. They choose to make a mockery of the law by offering a skewed choice: Typically a super simple opt-in (to hand them all your data) vs a highly confusing, frustrating, tedious opt-out (and sometimes even no reject option at all).

Make no mistake: This is ignoring the law by design. Sites are choosing to try to wear people down so they can keep grabbing their data by only offering the most cynically asymmetrical ‘choice’ possible.

However since that’s not how cookie consent is supposed to work under EU law sites that are doing this are opening themselves to large fines under the General Data Protection Regulation (GDPR) and/or ePrivacy Directive for flouting the rules.

See, for example, these two whopping fines handed to Google and Amazon in France at the back end of last year for dropping tracking cookies without consent…

While those fines were certainly head-turning, we haven’t generally seen much EU enforcement on cookie consent — yet.

This is because data protection agencies have mostly taken a softly-softly approach to bringing sites into compliance. But there are signs enforcement is going to get a lot tougher. For one thing, DPAs have published detailed guidance on what proper cookie compliance looks like — so there are zero excuses for getting it wrong.

Some agencies had also been offering compliance grace periods to allow companies time to make the necessary changes to their cookie consent flows. But it’s now a full three years since the EU’s flagship data protection regime (GDPR) came into application. So, again, there’s no valid excuse to still have a horribly cynical cookie banner. It just means a site is trying its luck by breaking the law.

There is another reason to expect cookie consent enforcement to dial up soon, too: European privacy group noyb is today kicking off a major campaign to clean up the trashfire of non-compliance — with a plan to file up to 10,000 complaints against offenders over the course of this year. And as part of this action it’s offering freebie guidance for offenders to come into compliance.

Today it’s announcing the first batch of 560 complaints already filed against sites, large and small, located all over the EU (33 countries are covered). noyb said the complaints target companies that range from large players like Google and Twitter to local pages “that have relevant visitor numbers”.

“A whole industry of consultants and designers develop crazy click labyrinths to ensure imaginary consent rates. Frustrating people into clicking ‘okay’ is a clear violation of the GDPR’s principles. Under the law, companies must facilitate users to express their choice and design systems fairly. Companies openly admit that only 3% of all users actually want to accept cookies, but more than 90% can be nudged into clicking the ‘agree’ button,” said noyb chair and long-time EU privacy campaigner, Max Schrems, in a statement.

“Instead of giving a simple yes or no option, companies use every trick in the book to manipulate users. We have identified more than fifteen common abuses. The most common issue is that there is simply no ‘reject’ button on the initial page,” he added. “We focus on popular pages in Europe. We estimate that this project can easily reach 10,000 complaints. As we are funded by donations, we provide companies a free and easy settlement option — contrary to law firms. We hope most complaints will quickly be settled and we can soon see banners become more and more privacy friendly.”

To scale its action, noyb developed a tool which automatically parses cookie consent flows to identify compliance problems (such as no opt out being offered at the top layer; or confusing button coloring; or bogus ‘legitimate interest’ opt-ins, to name a few of the many chronicled offences); and automatically create a draft report which can be emailed to the offender after it’s been reviewed by a member of the not-for-profit’s legal staff.

It’s an innovative, scalable approach to tackling systematically cynical cookie manipulation in a way that could really move the needle and clean up the trashfire of horrible cookie pop-ups.

noyb is even giving offenders a warning first — and a full month to clean up their ways — before it will file an official complaint with their relevant DPA (which could lead to an eye-watering fine).

Its first batch of complaints are focused on the OneTrust consent management platform (CMP), one of the most popular template tools used in the region — and which European privacy researchers have previously shown (cynically) provides its client base with ample options to set non-compliant choices like pre-checked boxes… Talk about taking the biscuit.

A noyb spokeswoman said it’s started with OneTrust because its tool is popular but confirmed the group will expand the action to cover other CMPs in the future.

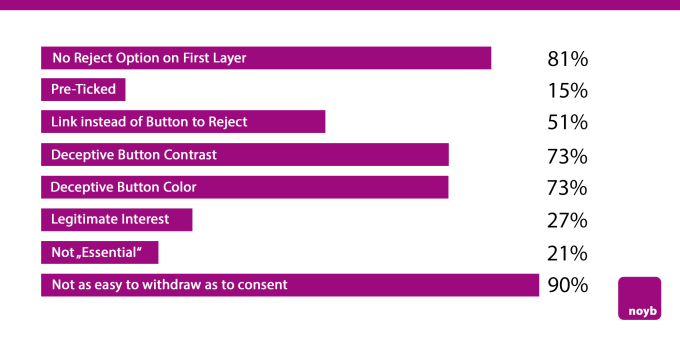

The first batch of noyb’s cookie consent complaints reveal the rotten depth of dark patterns being deployed — with 81% of the 500+ pages not offering a reject option on the initial page (meaning users have to dig into sub-menus to try to find it); and 73% using “deceptive colors and contrasts” to try to trick users into clicking the ‘accept’ option.

noyb’s assessment of this batch also found that a full 90% did not provide a way to easily withdraw consent as the law requires.

Cookie compliance problems found in the first batch of sites facing complaints (Image credit: noyb)

It’s a snapshot of truly massive enforcement failure. But dodgy cookie consents are now operating on borrowed time.

Asked if it was able to work out how prevalent cookie abuse might be across the EU based on the sites it crawled, noyb’s spokeswoman said it was difficult to determine, owing to technical difficulties encountered through its process, but she said an initial intake of 5,000 websites was whittled down to 3,600 sites to focus on. And of those it was able to determine that 3,300 violated the GDPR.

That still left 300 — as either having technical issues or no violations — but, again, the vast majority (90%) were found to have violations. And with so much rule-breaking going on it really does require a systematic approach to fixing the ‘bogus consent’ problem — so noyb’s use of automation tech is very fitting.

More innovation is also on the way from the not-for-profit — which told us it’s working on an automated system that will allow Europeans to “signal their privacy choices in the background, without annoying cookie banners”.

At the time of writing it couldn’t provide us with more details on how that will work (presumably it will be some kind of browser plug-in) but said it will be publishing more details “in the next weeks” — so hopefully we’ll learn more soon.

A browser plug-in that can automatically detect and select the ‘reject all’ button (even if only from a subset of the most prevalent CMPs) sounds like it could revive the ‘do not track’ dream. At the very least, it would be a powerful weapon to fight back against the scourge of dark patterns in cookie banners and kick non-compliant cookies to digital dust.

Fintech in Africa is a goldmine. Investors are betting big on startups offering a plethora of services from payments and lending to neobanks, remittances and cross-border transfers, and rightfully so. Each of these services solves unique sets of challenges. For cross-border payments, it’s the outrageous rates and regulatory hassles involved with completing transactions from one African country to another.

Chipper Cash, a three-year-old startup that facilitates cross-border payment across Africa, has closed a $100 million Series C round to introduce more products and grow its team.

It hasn’t been too long ago since Chipper Cash was last in the news. In November 2020, the African cross-border fintech startup raised $30 million Series B led by Ribbit Capital and Jeff Bezos fund Bezos Expeditions. This was after closing a $13.8 million Series A round from Deciens Capital and other investors in June 2020. Hence, Chipper Cash has gone through three rounds totalling $143.8 million in a year. However, when the $8.4 million raised in two seed rounds back in 2019 is included, this number increases to $152.2 million.

SVB Capital, the investment arm of U.S. high-tech commercial bank Silicon Valley Bank led this Series C round. Others who participated in this round include existing investors — Deciens Capital, Ribbit Capital, Bezos Expeditions, One Way Ventures, 500 Startups, Tribe Capital, and Brue2 Ventures.

Chipper Cash was launched in 2018 by Ham Serunjogi and Maijid Moujaled. The pair met in Iowa after coming to the U.S. for studies. Following their stints at big names like Facebook, Flickr and Yahoo!, the founders decided to work on their own startup.

Last year, the company which offers mobile-based, no fee, P2P payment services, was present in seven countries: Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa and Kenya. Now, it has expanded to a new territory outside Africa. “We’ve expanded to the U.K., it’s the first market we’ve expanded to outside Africa,” CEO Serunjogi said to TechCrunch.

In addition and as a sign of growth, the company which boasts more than 200 employees plans to increase its workforce by hiring 100 staff throughout the year. The number of users on Chipper Cash has increased to 4 million, up 33% from last year. And while the company averaged 80,000 transactions daily in November 2020 and processed $100 million in payments value in June 2020, it is unclear what those figures are now as Serunjogi declined to comment on them, including its revenues.

When we reported its Series B last year, Chipper Cash wanted to offer more business payment solutions, cryptocurrency trading options, and investment services. So what has been the progress since then? “We’ve launched cards products in Nigeria and we’ve also launched our crypto product. We’re also launching our US stocks product in Uganda, Nigeria and a few other countries soon,” Serunjogi answered.

Crypto is widely adopted in Africa. African users are responsible for a sizeable chunk of transactions that take place on some global crypto-trading platforms. For instance, African users accounted for $7 billion of the $8.3 billion in Luno’s total trading volume. Binance P2P users in Africa also grew 2,000% within the past five months while their volumes increased by over 380%.

Individuals and small businesses across Nigeria, South Africa and Kenya account for most of the crypto activity on the continent. Chipper Cash is active in these countries and tapping into this opportunity is basically a no brainer. “Our approach to growing products and adding products is based on what our users find valuable. As you can imagine, crypto is one technology that has been widely adopted in Africa and many emerging markets. So we want to give them the power to access crypto and to be able to buy, hold, and sell crypto whenever,” the CEO added.

However, its crypto service isn’t available in Nigeria, the largest crypto market in Africa. The reason behind this is the Central Bank of Nigeria’s (CBN) regulation on crypto activities in the country prohibiting users from converting fiat into crypto from their bank accounts. To survive, most crypto players have adopted P2P methods but Chipper Cash isn’t offering that yet and according to Serunjogi, the company is “looking forward to any development in Nigeria that allows it to be offered freely again.”

The same goes for the investment service Chipper Cash plans to roll out in Nigeria and Uganda soon. Presently, Nigeria’s capital market regulator SEC is keeping tabs on local investment platforms and bringing their activities under its purview. Chipper Cash will not be exempt when the product is live in Nigeria and has begun engaging regulators to be ahead of the curve.

“As fintech explodes and as innovation continues to move forward, consumers have to be protected. We invest millions of dollars every year in our compliance programs, so I think working closely with the regulators directly so that these products are offered in a compliant manner is important,” Serunjogi noted.

During our call, Serunjogi made some remarks about Nigeria’s central bank which resembles comments made by Flutterwave CEO Olugbenga Agboola back in March.

While acknowledging the central banks in Kenya, Rwanda, Uganda for creating environments where innovation can thrive, he said: “Nigeria has probably the most exciting and vibrant tech ecosystem in Africa. And that’s credit directly to CBN for creating and fostering an environment that allowed multiple startups like ourselves and others like Flutterwave to blossom.”

Most fintechs would argue that the CBN stifles innovation but comments from both CEOs seems to suggest otherwise. From all indication, Chipper Cash and Flutterwave strive to be on the right side of the country’s apex bank policies and regulations. It is why they are one of the fastest-growing fintechs in the region and also billion-dollar companies.

“Obviously, we’re not getting into our valuation, but we’re probably the most valuable private startup in Africa today after this round. So that’s a reflection of the environment that regulators like CBN have created to allowed innovation and growth, ” Serunjogi commented when asked about the company’s valuation.

Up until last week, the only private unicorn startup in Africa this year was Flutterwave. Then China-backed and African-focused fintech OPay came along as the company was reported to be in the process of raising $400 million at a $1.5 billion valuation. If Serunjogi’s comment is anything to go by, Chipper Cash is currently valued between $1-2 billion thus joining the exclusive billion-dollar club.

But to be sure, I asked Serunjogi again if the company is indeed a unicorn. This time, he gave a more cryptic answer. “We’re not commenting on the size of our valuation publicly. One of the things that I’ve been quite keen on internally and externally is that the valuation of our company has not been a focus for us. It’s not a goal we’re aspiring to achieve. For us, the thing that drives us is that we have a product that is impactful to our users.”

Maijid Moujaled (CTO) and Ham Serunjogi (CEO)

Serunjogi added that this investment actualizes the importance of possessing a solid balance sheet and onboarding SVB Capital and getting existing investors to double down is a means to that end. According to him, a strong balance sheet will provide the infrastructure needed to support key long-term investments which will translate to more exciting products down the road.

“We look at our investors as key partners to the business. So having very strong partners around the table makes us a stronger company. These are partners who can put capital into our business, and we’re also able to learn from them in several other ways,” he said of the investors backing the three-year-old company.

Just like Ribbit Capital and Bezos Expeditions in last year’s Series B, this is SVB Capital’s first foray into the African market. In an email, the managing director of SVB Capital Tilli Bannett, confirmed the fund’s investment in Chipper Cash. According to him, the VC firm invested in Chipper Cash because it has created an easy and accessible way for people living in Africa to fulfil their financial needs through enhanced products and user experiences.

“As a result, Chipper has had a phenomenal trajectory of consumer adoption and volume through the product. We are excited at the role Chipper has forged for itself in fostering financial inclusion across Africa and the vast potential that still lies ahead,” he added.

Fintech remains the bright spot in African tech investment. In 2020, the sector accounted for more than 25% of the almost $1.5 billion raised by African startups. This figure will likely increase this year as four startups have raised $100 million rounds already: TymeBank in February, Flutterwave in March, OPay and Chipper Cash this May. All except TymeBank are now valued at over $1 billion, and it becomes the first time Africa has seen two or more billion-dollar companies in a year. In addition to Jumia (e-commerce), Interswitch (fintech), and Fawry (fintech), the continent now has six billion-dollar tech companies.

Here’s another interesting piece of information. The timeframe at which startups are reaching this landmark seems to be shortening. While it took Interswitch and Fawry seventeen and thirteen years respectively, it took Flutterwave five years; Jumia, four years; then OPay and Chipper Cash three years.

Intel kicked off this year’s virtual Computex by announcing two new 11th Gen U-Series chips for use in thin, lightweight laptops. It also unveiled its first 5G M.2 module for laptops, designed in a partnership with MediaTek (Intel sold its smartphone modem business to Apple in 2019).

Both of Intel’s new chips have Intel Irix Xe graphics. The flagship model is the Core i7-1195G7, which has base clock speed is 2.9 GHz, but can reach up to 5.0 GHz on a single core using Intel’s Turbo Boost Max 3.0 tech. The other chip, called the Core i5-1155G7, has a base clock speed of 2.5GHzm and a maximum of 4.5GHz. Both chips have four cores and eight threads.

The 5G M.2 module, called the “5G Solution 5000,” supports 5G NR midband, sub-6GHz frequencies and eSIM tech. Intel has partnerships with telecoms in North America, EMEA, APAC, Japan and Australia. The module is expected to be in laptops produced by Acer, ASUS, HP and other manufacturers by the end of this year, and OEMs are also working on 250 designs based on 11th Gen U-Series chips, expected to hit the market by the holidays.

The vast majority of people in India, the world’s second most populous nation, don’t have health insurance coverage. A significant portion of the population that does have coverage get it from their employers.

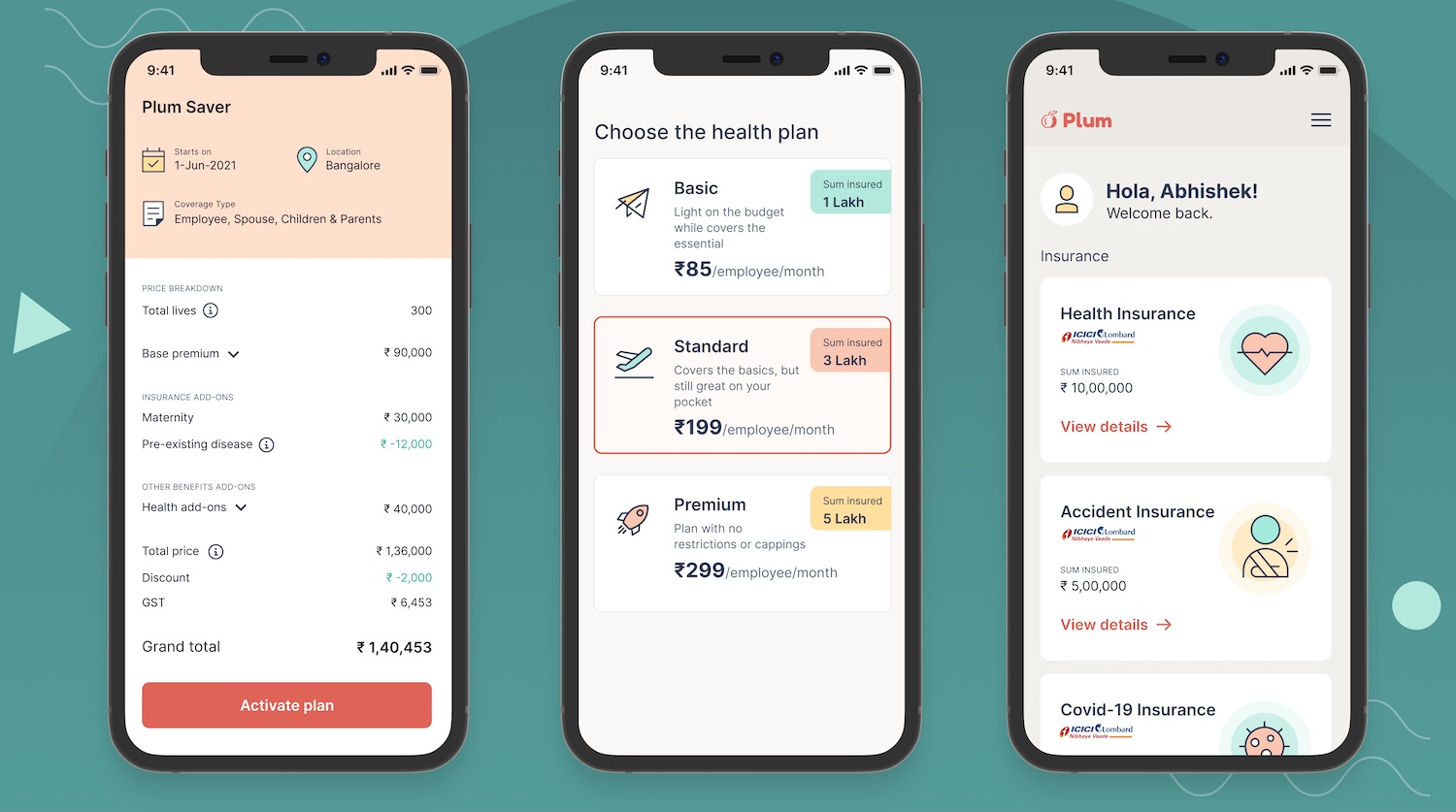

Plum, a young startup that is making it easier and more affordable for more firms in the nation to provide insurance coverage to their employees, said on Monday it has raised $15.6 million in its Series A funding to accelerate its growth. Tiger Global led the funding round.

Existing investors Sequoia Capital India’s Surge, Tanglin Venture Partners, Incubate Fund, Gemba Capital, also participated in the new round, which brings the one-a-half-year-old startup’s to-date raise to $20.6 million. TechCrunch reported earlier this year that Plum was in talks with Tiger Global for the new financing round.

Kunal Shah (founder of Cred), Gaurav Munjal, Roman Saini and Hemesh Singh (founders of Unacademy), Lalit Keshre, Harsh Jain and Ishan Bansal (founders of Groww), Ramakant Sharma and Anuj Srivastava (founders of Livspace), and Douglas Feirstein (founder of Hired) also participated in the new round.

Plum offers health insurance coverage on a B2B2C model. The startup partners with small businesses to provide health insurance coverage to all their employees (and their family members), charging as little as $1 a month for an employee.

The startup has developed the insurance stack from scratch and partnered with insurers to include additional coverage on pre-existing conditions and dental, said Abhishek Poddar, co-founder and chief executive of Plum, in an interview with TechCrunch.

(Like fintech firms, which partner with banks and NBFCs to provide credit to customers, online insurance startups have partnerships with insurers to provide health insurance coverage. Plum maintains partnerships with ICICI Lombard, Care Health, Star Health and New India Assurance.)

Poddar, who has worked at Google and McKinsey, said Plum is making it increasingly affordable and enticing for businesses to choose the startup as their partner. Most insurance firms and online aggregators in India today currently serve consumers. There are very few players that engage with businesses. Even among those that do, they tend to be costlier and not as flexible.

Plum offers its partnered client’s employees the option to top up their health insurance coverage or extend it to additional members of the family. Unlike its competitors that require all the premium to be paid annually, Plum gives its clients the ability to pay each month. And signing up an entire firm for Plum takes less than an hour. (The speed is a key differentiator for Plum. Small businesses have to typically spend months in negotiating with other insurers. Bangalore-based Razorpay has also partnered with Plum to give the fintech startup’s clients a three-click, one-minute option to sign up for insurance coverage.)

The startup plans to deploy the fresh capital to further expand its offerings, making its platform open to smaller businesses with teams as small as seven employees to sign up, said Poddar. The startup plans to cover 10 million people in India with insurance by 2025, and eventually expand to international markets, he said.

India has an under-penetrated insurance market. Within the under-penetrated landscape, digital distribution through web-aggregators today accounts for just 1% of the industry, analysts at Bernstein wrote in a recent report.

“As India’s healthcare insurance industry rapidly expands and transforms, Plum is well positioned to make comprehensive health insurance accessible to millions of Indians. We are excited to partner with Abhishek, Saurabh and the Plum team as they scale their leading tech-enabled platform to employers across the country,” said Scott Shleifer, Partner at Tiger Global, in a statement.

Plum is the latest investment from Tiger Global in India this year. The hedge fund, which has backed over 20 Indian unicorns, has emerged as the most prolific investor in Indian startups in recent months, winning founders with its pace of investment, check size and favorable terms. Last week, the firm invested in Indian social network Koo.

Jai Kisan, an Indian startup that is attempting to bring financial services to rural India, where commercial banks have a single-digit penetration, said on Monday it has raised $30 million in a new financing round as it looks to scale its business.

Hundreds of millions of people in India today live in rural areas. Most of them don’t have a credit score. The professions they work on — largely farming — aren’t considered a business by most lenders in India. These farmers and other professionals also don’t have a documented credit history, which puts them in a risky category for banks to grant them a loan.

Much of the credit these people do raise ends up getting invested in unproductive usage, which leads to higher interest and default rates.

Three-year-old Mumbai-headquartered Jai Kisan is attempting to address this by treating farmers and other similar professionals as businesses instead of consumers.

The startup has developed its own system — which it calls Bharat Khata — that is helping individuals and businesses get access to cheaper financing and ensures that the money they raise is being used for agri-inputs and equipment and other income generating purposes and enablement of rural commerce transactions.

Arjun Ahluwalia, co-founder and chief executive of Jai Kisan, said financial services is crucial for these individuals as their entire economy depends on it. “The ability to buy now and pay later is how most people shop for things in India. Credit is an expectation by the Indian customer — it’s not a value added service,” he told TechCrunch in an interview.

“If there is availability of formal financing to customers, it’s not just customer who does well. The entire ecosystem that revolves around that customer benefits,” he said, pointing to the rise of Bajaj Finance, which has helped several businesses flourish in India by giving credit to customers at the time of purchase, and Xiaomi, India’s largest smartphone vendor, which sells a large number of its devices to customers on monthly instalment plans.

Ahluwalia at a conference in 2019. (India FinTech Forum)

Bharat Khata service, which was launched in April last year, captured more than $380 million of annualized GTV run-rate across over 25,000 storefronts by the financial year that ended in March this year, the startup said.

“Jai Kisan has financed over 15% of the transactions which portrays the monetizability and quality of commerce being captured. The ability to have visibility and virality of high-quality transactions has enabled Jai Kisan to scale business by over 50% in 3 months. The unprecedented growth trajectory stands testament to Jai Kisan’s capabilities to deploy capital efficiently by focusing on core customer credit needs,” the startup said.

The startup, which operates in eight Indian states in South India, is now looking to scale its presence across the country and also increase the headcount. On Monday, it said it had raised $30 million in a Series A round led by Mirae Asset, Syngenta Ventures, and existing investors Blume, Arkam Ventures, NABVENTURES, Prophetic Ventures and Better Capital.

An unspecified amount of the financing was raised as debt from Blacksoil, Stride Ventures, and Trifecta Capital.

“Jai Kisan is at the cusp of disrupting the rural financing industry and we’re glad to be a part of their growth story. Jai Kisan’s stellar growth, excellent asset quality and expanding footprint make them a highly differentiated player in the segment,” said Ashish Dave, chief executive of the India Venture Investments for the South Korean firm Mirae Asset.

“Mirae Asset has always believed in backing companies which aim to become category leaders which is evident from our other investments and we believe Jai Kisan is on the journey of doing so for rural finance,” he added.

Like most fintech startups, Jai Kisan has so far relied on its banking and other financial institutions to finance credit to businesses. The startup said it will now finance 20% of all loans by itself. Which is why it is also raising some money in debt in the new round.